Let’s start off with a snippet from the research department of TD Securities, ‘The recent slowdown in housing market activity will likely figure prominently in the Fed’s discussions on the US economic recovery. While the pace of home sales activity remains quite weak, the dramatic fall in available supply is finally beginning to provide some support for prices. In February, we expect home prices to post a modest 0.2% m/m gain, marking the first monthly gain (on a seasonally-adjusted basis) in this indicator since May last year.’

Our view is that it makes more sense to forecast the economy off of the markets than the other way around. The markets are constantly discounting future events which means that there is typically a period of time ‘at the turns’ when the markets are at odds with ‘the news’.

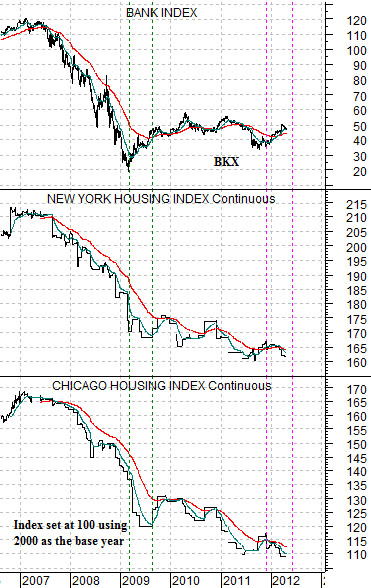

We have two arguments based upon this. First, the trend for the banking shares is similar to the trend for U.S. housing prices. At right is a comparison between the Bank Index (BKX) and the housing index futures for New York and Chicago. The index futures were set at 100 with a baseline from the year 2000. A level today of, say, 110 means that home prices in that particular city are 10% higher than they were around 12 years ago.

Second, the equity markets should ‘lead’. The Bank Index should turn upwards months ahead of confirmation from housing prices.

The issue at present is that the Bank Index swung upwards around the end of 2011 even as home prices in both New York and Chicago have continued to decline. In fact, much of our work over the past few weeks has been based on the idea that a critical markets event took place around the start of this year to mark the beginning of a rising trend for yields and a sustainable positive trend for the laggard banks.

The point is that a rising trend for the Bank Index in the face of declining home prices only makes sense if the equity markets are doing their usual job of accurately forecasting the future. If we are at ‘the turn’ then it makes perfect sense that the equity markets are once again at odds with ‘the news’. However, with the markets starting to lose momentum our view is that an improving trend for home prices will have to start showing up sooner rather than later.

Equity/Bond Markets

NEW YORK (CNNMoney) — Home prices hit new post-bubble lows in February, according to a report out Tuesday.

The S&P/Case-Shiller home price index of 20 cities recorded a decline of 3.5% from 12 months earlier. Home prices have not been this low since November 2002.

There is ‘the news’ and then there is the way the markets react to ‘the news’.

We showed the charts below in yesterday’s issue but wish to take another run at the argument from a slightly different perspective.

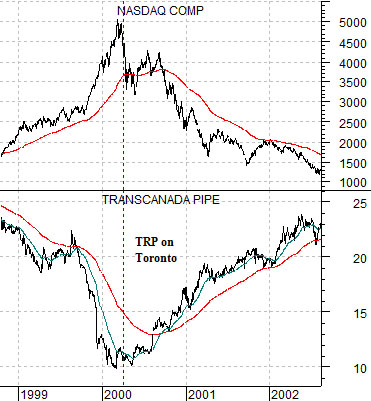

In the spring of 2000 the Nasdaq Composite Index peaked while the share price of TransCanada (TRP) bottomed. These two events marked a significant change in trend as cyclical growth turned negative along with interest rates.

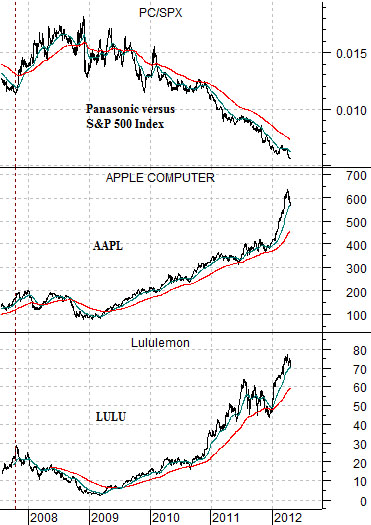

The chart below compares the share price of Lululemon (LULU) and Apple (AAPL) with the ratio between Panasonic (PC) and the S&P 500 Index (SPX).

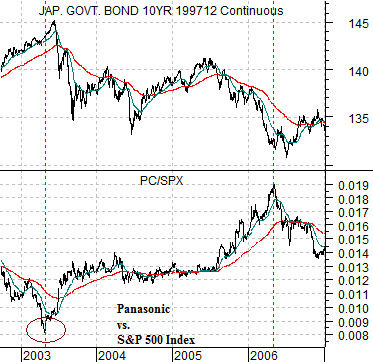

The argument is (from the chart below) that the PC/SPX ratio tends to move in the opposite direction of bond prices. When this ratio stops declining and starts to swing higher there is a reasonable chance that bond prices are approaching some kind of multi-year price peak.

The idea is that recent weakness in both Apple and Lululemon might simply reflect the markets taking a well deserved breather after months of furious price gains ahead of Apple’s quarterly earnings report (12.30 vs. 10.04 expected). On the other hand it could also represent something similar to the Nasdaq and TRP comparison from 2000. In other words… a significant change in trend in response to a bottom in the PC/SPX ratio and an impending decline in long-term Treasury bond prices. If this is the case then the markets are ‘saying’ that the downward pressure on yields from the U.S. housing market came to a conclusion with the release of the February data yesterday.