Oct. 9 (Bloomberg) — Gold prices dropped, paring the biggest weekly advance since April, as a stronger dollar cut demand and some investors sold the metal to lock in gains from its climb to a record.

Gold prices closed marginally lower on Friday so we thought we would do an intermarket review of some of the factors that influence or drive the price of gold.

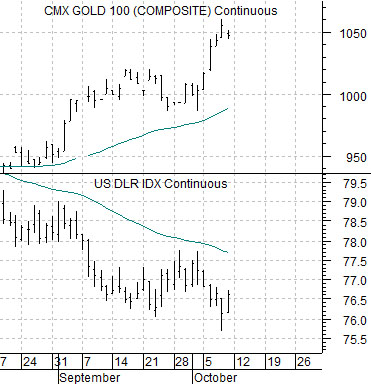

Below is a comparison between gold futures and the U.S. Dollar Index (DXY) futures.

This relationship is fairly straight forward. The weaker the dollar the stronger the trend for gold prices. Weak dollar, strong gold. And vice versa.

Below is a comparative view of gold futures and the Swiss franc futures.

We have argued over the years that while individual currencies may rise and fall (with the dollar doing more falling than rising) the key for gold prices lies with the Swiss franc. We have no idea why although the Swiss have long been known for being more than willing to hold the watches and wallets while others do battle.

The Swiss franc futures traded above parity with the U.S. dollar back in the first half of 2008 as gold futures prices made their first foray to ‘four figures’. From there the franc sold off into the low .80’s as gold prices tumbled back towards 700.

The trend from the fourth quarter of 2008 through to the present day has included renewed strength in the Swiss franc and rather relentless strength for gold prices. We have mentioned on occasion that our view is that gold prices can rise above 1000 but for prices to remain there the Swiss franc is going to have to rise through and remain above parity with the dollar. Since it is our conviction that this will not happen… we are inclined towards a negative view on gold prices.

So… why were gold prices lower on Friday? Two simple answers would be that the U.S. dollar was a bit stronger and the Swiss franc was a bit weaker. Fair enough.

There was more at work at the end of last week than mere dollar strength. To explain we show a chart of the U.S. 30-year T-Bond futures and the ratio between gold and copper futures.

The gold/copper ratio rises with the bond market. In other words when bond prices are stronger gold will outperform copper. Copper tends to do better when interest rates are rising while gold does better- on a relative basis- when yields are declining.

On Friday the bond market sold off quite sharply. At the same time copper prices were also lower. When bonds AND copper are lower the path of least resistance for gold prices is down.

Below we show another metals-oriented relationship that is based on the forex markets. The chart compares the sum of copper (in cents) and gold (in dollars) prices with the cross rate between the Australian dollar (AUD) futures and Canadian dollar (CAD) futures.

When the Aussie dollar is rising relative to the Cdn dollar… metals prices tend to strengthen. On Friday the AUD was down while the CAD was up. The end result was a small decline in metals prices.

Above we showed that gold prices tend to trend inversely to the dollar. We have also argued that gold prices tend to do better- at least relative to copper- when bond prices are stronger. The best intermarket back drop for gold is a combination of a weak dollar AND rising long-term Treasury prices.

The chart below compares gold futures with the spread or difference between the U.S. Dollar Index (DXY) and U.S. 30-year T-Bond futures. On Friday the DXY rose by a bit less than half a point while the TBonds fell by 1.75 points. The end result of dollar strength and bond price weakness was a ‘lift’ in the spread. If gold prices tend to rise when the dollar is weak and bond prices are strong… on any given day when the dollar is strong and bond prices are weaker you will generally see gold prices falling. Such was the case on Friday.