We have argued over the past few weeks that if it ain’t broken, don’t fix it. Or, we suppose, if nothing changes, don’t fade it.

The premise has been that the equity markets are trending higher as an offset to a flat dollar and bond market. As long as bond prices and the U.S. Dollar Index are not busting to new highs the equity markets have responded with a significantly bullish tilt. Meanwhile the Greek stock market (chart on page 6) is swinging to the upside, the Japanese yen has finally turned lower, and China is getting a bit more aggressive with monetary easing.

Bloomberg, February 19, 2012: China is seen making more cuts to banks’ reserve requirements to fuel lending and sustain economic growth as the housing market cools and Europe’s sovereign-debt crisis weighs on exports.

First is our comparative chart of the S&P 500 Index (SPX), the price spread or difference between the 30-year and 10-year Treasury futures (30- 10), and the sum of the price of the U.S. 30-year T-Bond futures plus the U.S. Dollar Index (DXY) futures.

The argument was that the peak for bond prices (representing the low point for confidence or high point for markets stress) occurred around the end of last year’s third quarter as the price spread between the 30-year and 10-year Treasuries widened out to just over 14 points while the sum of the TBond and DXY moved above 225.

The markets returned to test the point of ‘maximum stress’ at various points in time from November through January but each time the 30- 10 spread failed to move appreciably above +14 and the sum of the TBond and DXY stalled between 225 and 227… the S&P 500 Index resolved higher.

Our view is that investors are far too nervous for this to be an equity markets top. Our contention is that as long as the bond market and dollar stay range bound the SPX should continue to grind upwards within the rough confines of its trading channel. Our opinion is that it doesn’t make sense to fade the rally until the intermarket forces acting upon it change in some way.

Equity/Bond Markets

While not particularly relevant to anything we couldn’t help but notice one head line last Friday, ‘(Reuters) – Italian police said on Friday they had seized about $6 trillion worth of fake U.S. Treasury bonds and other securities in Switzerland, and arrested eight Italians accused of international fraud and other financial crimes… The fake securities, worth more than a third of U.S. national debt, were seized in January from a Swiss trust company…’. Go big or go home. Or to prison.

We were gently chided by one of our readers last week with regard to our latest rant directed at the Federal Reserve’s Open Market Committee statement. The FOMC suggested that the economic outlook was ‘likely to warrant exceptionally low levels for the federal funds rate at least through late 2014’.

We accept the notion that the FOMC did not state that the funds rate would be held near 0% through 2014 but only that it was ‘likely’. Fair enough.

Our reader suggested that by taking issue with this point we were, in fact, fighting the Fed. The term ‘Don’t fight the Fed’ is generally attributed to Marty Zweig who coined the phrase back in his professorial days. It is, in fact, one the rules that we try to adhere to because it is our contention that what the Fed wants… the Fed invariably gets.

Our point was that the Fed actually lags the bond market. From this we conclude two things. First, it probably makes more sense to not fight the bond market. Second, the Fed actually has no idea what it will be doing 2 to 3 years from now unless it can consistently and accurately forecast the thoughts, decisions, and assumptions of the ‘bond market’ that far out into the future.

To us ‘Don’t fight the Fed’ does not mean that we can’t disagree with its policy statements. At present the Fed is actively attempting to stimulate growth and inflate asset prices so the only way that we could truly fight the Fed is by being equity markets bearish. Which, of course, we aren’t and haven’t been for many months.

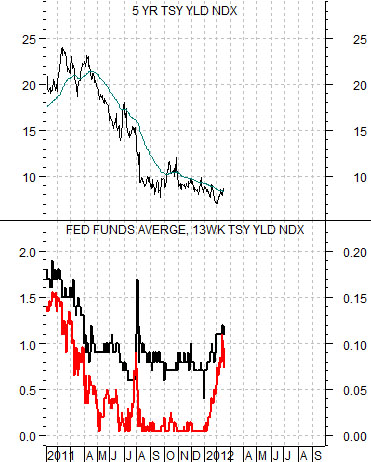

Below is a chart of 5-year Treasury yields and an overlay of the funds rate (in black) and 3-month TBill yields (in red).

Notice that the red line (TBill yields) was consistently lower than the black line (Fed funds) from 2003 into 2004. In May of 2004 the red line crossed up through the black line as 3-month TBill yields moved above the overnight funds rate. Notice that this happened almost a full year AFTER 5-year yields began to rise. In fact… 5-year yields rose from 2% to 4% before there was enough upward pressure through the yield curve to move TBill yields above the funds rate. In June of 2004- the FOMC meeting following the ‘cross over’- the Fed bumped the funds rate for the first time since the Nasdaq’s meltdown post-2000.

The point? We aren’t fighting the Fed. We are, however, taking issue with the assertion that conditions will require ‘exceptionally low’ interest rates over the next three years. Our view is that by the time 5-year yields have risen for close to a year we should start to anticipate a funds rate hike. If 5-year yields rise for close to a year AND TBill yields not only move above the funds rate but also cross above .25% then our expectation will be that the Fed will bump Fed funds at the conclusion of the next scheduled meeting. The good news, of course, is that 5-year yields have yet to truly pivot higher so this particular issue will likely not come into play before the first quarter of 2013.