Given that the trend today will likely reflect either the economic strength or weakness from the weekly U.S. jobless claims report… we thought that we would take this opportunity to build a bit of a case in favor of the airline stocks. To get from here to there, however, will require a bit of a circular route.

To start with… we should admit that we absolutely loathe airplane travel although it does serve as a rather nice intermarket link between cyclical growth and the relative strength of energy prices. The share price of AMR reached its last relative peak more than 20 years ago so, in a sense, the airline stocks are in a similar position to the Japanese equity market.

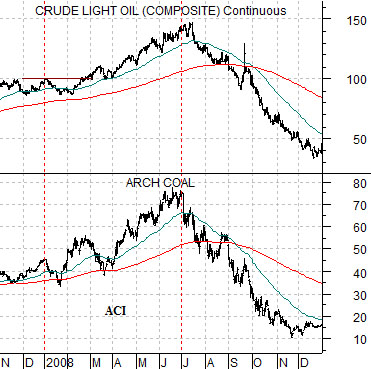

First up is a chart of crude oil futures and the share price of Arch Coal (ACI) from late 2007 through 2008.

2008 may not be the best example but hopefully it will suffice for the time being. The argument has been that the energy sector has tended to dominate the markets over the first six months of the year with ‘something else’ showing strength during the final six months. The ‘something else’ varies from year to year and has, in recent times, included the price of gold. To keep things as simple as possible let’s just write that from January through June the markets have exhibited a tendency to push energy prices upwards. In 2008 this trend included everything from crude oil to natural gas to the coal stocks. Notice that Arch Coal was very strong into June and then almost immediately turned back to the down side at the start of the third quarter.

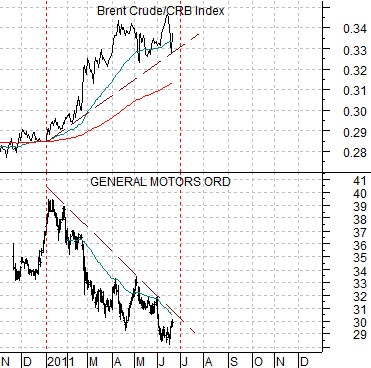

Next is a comparison between General Motors (GM) and the ratio between Brent crude futures and the CRB Index.

We have argued that the ‘strong energy’ trend this year has focused on Brent crude and gasoline futures. The offset to rising energy prices has been downward pressure on a number of energy ‘using’ sectors including the auto makers. Hence… the comparison to GM.

If the markets pivot at midyear then weakness in Brent crude and gasoline futures should go with an upswing for GM. Since the trends are fairly well defined anything north of 31- 32 for GM should at least indicate that the markets have pushed on to new things after a couple of quarters of energy price fixation.

Equity/Bond Markets

So… let’s see if we can take the page 1 arguments and apply them to the airline stocks.

Below is a chart of AMR from 2005 into the spring of 2007. We are going back in time somewhat because we would like to point out a somewhat interesting chart ‘detail’.

Through the previous decade there was a bit of a ‘lag’ between the start of energy price weakness and the start of a rising trend for AMR. Our argument was that energy prices pushed higher through the end of June yet the chart shows that AMR has tended to decline into August or September.

If history were to repeat then it would make sense to look at the airlines some time closer to the end of the next quarter. The problem is that the markets rarely seem to repeat exactly.

Next is the comparison between crude oil futures and Arch Coal from the current time frame. The charts rather clearly show that if we look at the energy price trend through these two markets… the trend turned bearish close to three months ago.

Our point? The best argument in favor of the airlines is weakness in energy prices. The best argument for waiting for a couple of months is the rather consistent 2-3 month lag between energy price weakness and actual airline stock price strength. The twist in the whole mess is the divergence between Brent crude and gasoline compared to WTI and the energy equities (Arch Coal, Suncor, Cameco, etc.) If we use Brent crude then the airlines are an idea for later this summer but if we use WTI then the argument becomes substantially more timely.

Lastly is a comparison between AMR and the ratio between crude oil and the CRB Index. Our sense is that the airlines trend turned positive back in April and that we are merely working through the ‘lag’ as we approach this year’s third quarter.