Generally when a market collapses one feels as if it should have been obvious. After all… weren’t we all warned time and time again about the ticking time bomb represented by sub-prime mortgages? In retrospect while the amount of damage may have been surprising the fact that there was, in fact, damage probably shouldn’t be.

It has been our experience that true crises tend to follow a series of well-publicized warnings. The problem is that each time the markets plow right through a warning investors perceive that there is no reason to eschew risk. As such… the game of markets musical chairs continues.

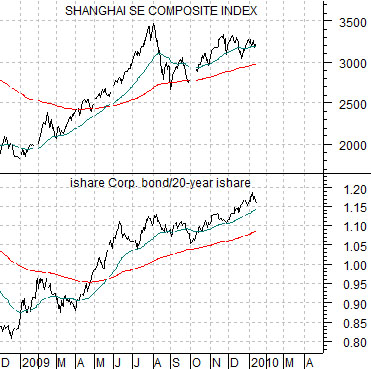

In any event… our focus of late has been on trying to find at least one market that is diverging. One market that is saying that money is starting to move back away from risk. At best we could point to the long end of the Treasury market which hasn’t seen new highs for yields since last June or, perhaps, China’s Shanghai Composite Index which remains somewhat below last August’s recovery peak. If we stretched a bit further afield we could argue that the equity markets of Egypt and Kuwait are still flirting with last year’s lows but, aside from that, the path of least resistance for capital still appears to be towards ‘risk’.

Below we show a combination of copper and crude oil futures prices and the sum of the Mexican peso futures and Brazilian real futures. In a strong cyclical trend- especially one focused on rising commodity prices- both of these charts should point higher. Which, of course, they have been doing.

Below is a comparison between the Shanghai Composite Index and the ratio between the corporate bond i-share (LQD) and the 20-year Treasury etf (TLT).

The point is that while trends always change- eventually- through trading yesterday the ongoing trend remains intact. Money is still pushing towards copper and crude oil prices and is still finding reason to bid up the peso and real. Money is still moving towards China and is consistently squeezing corporate bond yields down towards Treasury yields.

Our sense is that at some point later this year we will all realize that the markets well and thoroughly warned us about whatever problem that we are slogging through. At present, however, the trend is exhibiting so few cracks that one is led to conclude that the most obvious near-term outcome is ‘more of the same’.

Equity/Bond Markets

TOKYO — Panasonic Corp. said Monday it aims to more than double sales in India to $1 billion in the fiscal year ending March 2013 by capitalizing on the country’s rapidly growing demand for cars.

We will come back to this topic in the days ahead but our sense is that one of the key themes for this decade will be Asian consumer spending. In other words while the trend will shift from cyclical to defensive on occasion the dominant theme will tend to reflect consumer spending instead of raw materials prices.

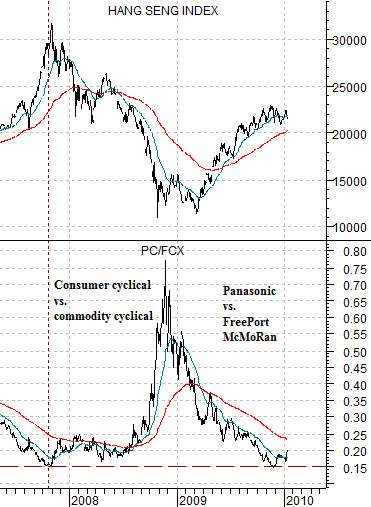

The chart just below compares the Hang Seng Index with the ratio between Panasonic (PC) and FreePort McMoRan (FCX). If our view is correct then the PC/FCX ratio should resolve higher over the next number of years.

Below is a rather large chart of the Canadian dollar (CAD) futures times 10-year U.S. Treasury yields.

The argument is that a strong cyclical trend will feature a rising Canadian currency AND relatively firm long-term Treasury yields. If one or the other starts to weaken then the underlying trend is shifting back away from ‘risk’.

The combination of the CAD times yields peaked in mid-2007 as the banks began to weaken and then again in the autumn at the highs for the Asian equity markets. A third top was reached in mid-2008 at the cycle peak for commodity prices.

The point is, we suppose, that as long as this combination holds above its moving average lines the trend for cyclical asset prices remains positive. Significant weakness in the commodity currencies or an ongoing trend towards lower long-term yields would indicate that a more defensive investment posture is warranted. Not yet, however.