The markets are doing their very best to confirm the notion that global economic growth has swung sharply positive. Very few sectors are arguing with this assessment but to start things off today we thought we would show two of them. They could well push on to new highs over the next few weeks but until then… we remain somewhat cautious.

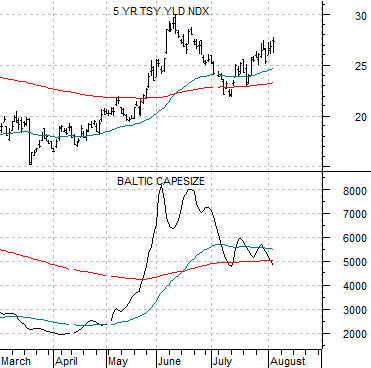

At right we compare the yield index for 5-year U.S. Treasuries (FVX) and the Baltic Capesize Index (BCI). The BCI is a subset of the broader Baltic Dry Index and represents the cost of shipping for the largest of the dry bulk carriers. Capesize vessels are used primarily for carrying coal and iron ore which means that the index tends to rise and fall with steel production.

We have read arguments that suggest that the BCI may well be a leading indicator for the broader Baltic Dry Index which, in turn, represents the trend for cyclical growth. Whether the BCI leads or lags is not our point however; instead we are simply trying to show that there are a few markets or sectors that are not busting out to new highs- yet.

The June peak for ocean freight costs lines up with the highs for longer-term Treasury yields. While yields have been marching upwards since early July they remain below the recent peak suggesting that there is at least a modicum of doubt surrounding the daily rise in equity and commodity prices.

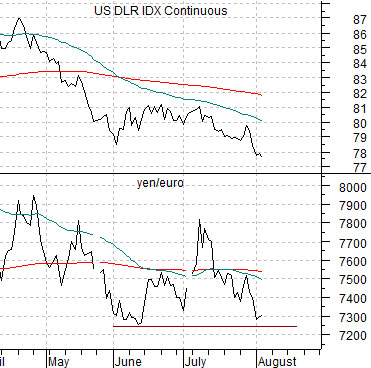

The equity markets have been feeding off of weakness in both the U.S. dollar and Japanese yen this year. One can argue, we suppose, that the dollar and yen now represent the source of funds that is fuelling the rise in foreign asset prices. The push above 1000 for the S&P 500 Index this week went with the break to new lows for the U.S. Dollar Index futures.

We have argued on occasion in the past that the trend for the dollar is actually driven by the trend for the cross rate between the Japanese yen and the euro. When the yen is weaker than the euro the dollar tends to decline and when the yen strengthens the dollar lifts as well.

The point is that while the U.S. Dollar Index (DXY) futures made new lows this week the yen/euro cross has managed to hold above the June lows which, in turn, line up with the peak for Treasury yields and the high point for ocean freight rates. These three markets- long-term Treasury yields, the yen/euro cross, and ocean freight rates- are still making the case that cyclical growth reached some sort of peak back in June.

Equity/Bond Markets

The recovery for cyclical growth this year has helped push long-term Treasury prices lower elevating yields. A number of markets and relationships have shown strong trends since last December so our thought is that it only makes sense to look for a directional change in the bond market if a similar case can be made for a few of these relationships.

At right we compare the ratio between Wells Fargo (WFC) and Canada’s Royal Bank (RY) with the ratio between the Canadian stock market and the U.S. stock market.

Below right we compare the U.S. 30-year T-Bond futures with the ratio between crude oil and natural gas futures.

Below we compare the crude oil/natural gas ratio with the ratio between gasoline futures and heating oil futures.

The argument is that concurrent with a steady increase in long-term Treasury yields which, in turn, reflected the resurgence in commodity-driven cyclical growth… the Canadian stock market rebounded against the U.S. stock market, the Canadian banks outperformed the U.S. banks, crude oil prices rose relative to natural gas prices, and… gasoline prices strengthen compared to heating oil prices.

Our initial focus is on the action in the TBonds since early June and the mirror-image picture shown through the crude oil/natural gas ratio. On page 1 we argued that a few markets still suggest that cyclical growth could have reached an extreme close to two months ago so the fact that the crude oil/natural gas ratio has held below the June highs while the TBonds remain above the lows is somewhat supportive.

The gasoline/heating oil ratio tends to peak around the Memorial Day long weekend in May so for the balance of the year the energy theme will tend to be dominated by heating oil fundamentals.