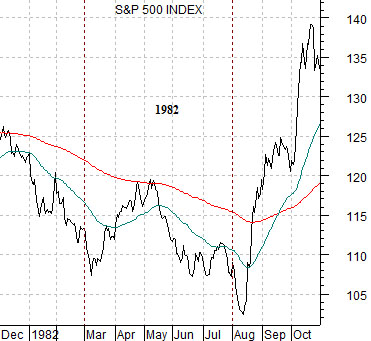

We start off today with a chart comparison between the S&P 500 Index (SPX) from 1982 (above) and the current time period.

Our ongoing argument has been that the SPX would make a bottom in March, rally for two months into May, and then retreat lower into August before swinging back to the upside. On the one hand we did a fairly good job of nailing the equity market’s swings this year but on the other… even this late in the cycle… we are still trying to figure out ‘why’ the equity markets will eventually rally.

Our thought is that the ‘why’ has something or, perhaps, everything to do with the bond market. We can make a case for cyclical strength in the face of falling bond prices and rising yields and we can make an equally compelling case based on rising bond prices and falling yields.

The two arguments go something like this. A weak bond market and rising yields would indicate that the economic stimulus thrown at the markets had gained traction leading to a surprisingly strong return to economic vigor. The stock market would most certainly be able to find enough good news in this scenario to push prices higher.

A strong bond market and falling yields actually makes more sense given our view that bear markets and recessions mark major changes in trend. This outcome would go with an end to the commodity-dominated trend and the start of a prolonged recovery led by the interest rate sensitive sectors. Valuations would expand as inflationary expectations cool.

We are showing the current market relative to 1982 for two reasons today. The first would be that this comparison served as part of the template that we were using for the March and August ‘bottoms’ scenario. The second is because 1982 marked the lows for the 1981- 82 bear market following a major commodity price rise through the end of the 1970’s with the August bear market bottom and subsequent pivot into a prolonged bull market reflecting bond price strength instead of bond price weakness. In other words after a thorough thrashing and cleansing in the wake of intense commodity price strength it is altogether possible for equities to rally as long-term Treasury yields decline. We will show another perspective on the following page.

Equity/Bond Markets

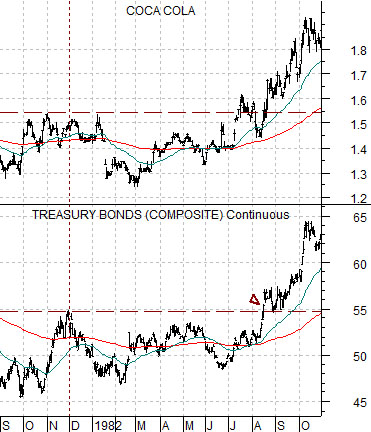

Below we show two charts of Coca Cola (KO) and the U.S. 30-year T-Bond futures. The top chart is from 1981- 82 while the lower chart is from 2008- 2009.

In early December of 1981 the TBonds made a price peak before sagging lower into 1982. The key point is that the equity market turned- rather abruptly- from a bearish trend to a bullish trend in August of 1982 as the TBond futures broke up through the highs set in late 1981. In other words the intermarket ‘trigger’ that marked the start of a very powerful equity bull market was a push to new highs by bond prices.

While the comparison is far from perfect the argument would be that the TBonds made a price peak in December of last year and after trending lower into June have started to rise once again. In 1982 and again in 2009 we are seeing bond price strength coming out of the second quarter.

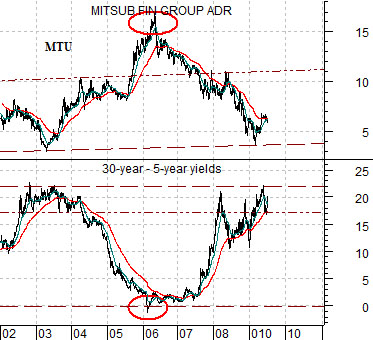

Below we show a comparison between Japan’s Mitsubishi UFJ (MTU) and the spread between 30-year and 5-year U.S. Treasury yields. The argument would be that one should buy MTU when 30-year yields rise to more than 2% higher than 5-year yields and sell it (a point we wished that we had made three years ago) when the spread approaches or moves below 0%.

If the downward pressure in the equity markets over the past year or so is- as we believe- a delayed reaction to the negative trend for MTU that began back in early 2006 and this negative trend was offset by a sharply widening yield curve then… and this is our ‘logical leap’… the eventual recovery will have to be offset by a tightening of the yield spread between 30-year and 5-year Treasury yields.

The yield spread can narrow if growth is so strong that shorter-term yields are forced higher- which is a possibility- or if long-term yields decline back towards short-term yields. The stock market could rally on the kind of economic strength that would force the Fed to raise the funds rate- similar to 1999- or on falling long-term yields similar to 1982. Either outcome would work and our lean is towards the latter outcome but we will quickly run through one of the arguments in favor of the former on the next page.