We have argued that the action through this year’s second quarter was crisis-related as money flowed away from risk and towards a number of perceived safe havens. Once the sense of crisis passed, however, the trends were expected to reverse as money moved gradually back towards more economically sensitive sectors.

In terms of ‘ready, set, go’ we are still probably mired somewhere close to ‘set’ although yesterday’s trading suggested that we might be on the verge of flipping over to ‘go’.

Below is a chart of 10-year U.S. Treasury yields.

The chart shows that yields began to decline at the start of April with a bottom right at the end of June. Given that trend changes often take place during the first few weeks of a new quarter with a propensity to swing some time close to the 22nd to 25th day of the first month… the re-test of the lows for yields on July 21st seemed appropriate. A bit knee-buckling to be sure but still appropriate.

With 2.9% holding last week we reached the ‘ready’ point. The rise in yields back up to the downtrending resistance line nudged the markets up to ‘set’ with a clear break of the resistance line serving to push the process up to ‘go’.

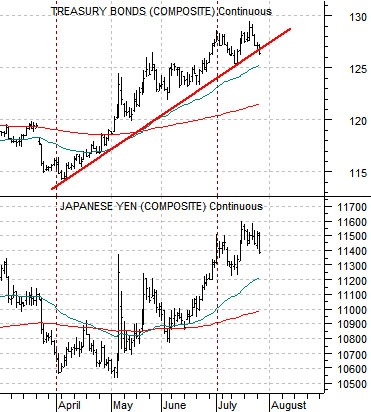

Below we show a chart of the 30-year T-Bond futures and the Japanese yen futures.

What we appreciated about yesterday’s trading action was the amount of confirmation from the various ‘safe haven’ markets. The Swiss franc declined, gold prices tumbled, bonds sold off, and the Japanese yen weakened. All in all it might have been a bad day for the risk-averse lemmings that pile from one sector into another based, we suspect, on arcane trend-following and momentum-driven quant programs but it was also a rather good day for our thesis.

A return to a more positive trend for ‘risk’ requires offsetting weakness in those sectors that money pushed into to avoid ‘risk’. With 10-year Treasury yields at resistance, the 30-year T-Bond futures flirting with support, and at least a modicum of weakness in the rising trend for the Japanese yen it really feels as if all it would take is another day like yesterday to shift the trend change from ‘set’ to ‘go’.

We feel somewhat inclined to beat one of our earlier points to death… once again. We showed this on yesterday’s fifth page but we thought we would drag it forward for today’s issue.

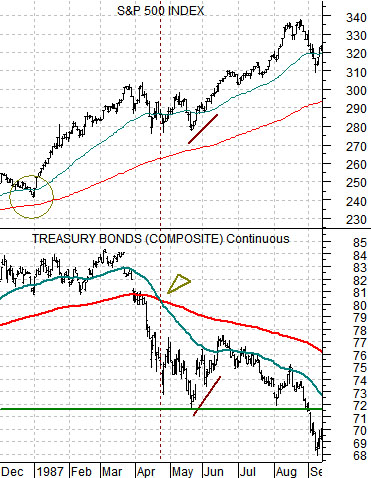

Below is a comparison between the S&P 500 Index (SPX) and the U.S. 30-year T-Bond futures from 1987.

Below we show the SPX and 30-year Treasury yields from 2010.

In a sense we are comparing apples to oranges or, perhaps, apples to wrenches. Something like that. In 1987 the equity market was trading with bond PRICES so when the TBond futures hit bottom in May the stock market pivoted- hard- back to the upside. The rising trend did not end until the TBond futures failed down through the May lows in August.

The argument was that once 30-year YIELDS bottomed this year the SPX would swing upwards. Which, of course, it did a few weeks back. We have also suggested that if the relationship holds the SPX will continue to climb until or unless 30-year yields break to new lows some time down the road. As long as 30-year yields are rising up and away from 3.85% it makes sense to hold a bullish view on the equity markets. This may prove to be a prolonged rally that last several years but just in case it runs into trouble later this year the ‘stop’ on the positive view would be anything south of 3.85% for 30-year yields.

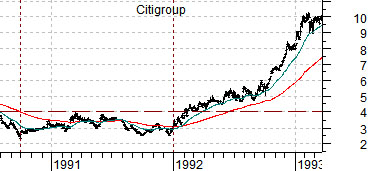

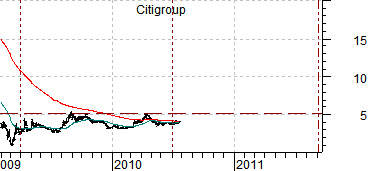

Below are two charts of Citigroup (C). Onhe starts during the second half of 1990 to include the bear market bottom in October of that year. The other chart begins in early 2009.

We have done this one on a number of occasions but… it continues to capture our attention and imagination. In both 1990 and 2009 the banks began to rally as the oil stocks started to lose relative strength. The share price of C lagged the recovery for a full 5 quarters before swinging upwards with a vengeance at the start of 1992. With the markets moving rapidly away from safe haven destinations yesterday our thoughts returned to the idea that it might be time for the laggard banks to kick things into gear.