The key question at this time is whether the bond market is rising in price temporarily in response to the series of crises emanating out of the Europe or whether, in fact, it is forecasting a significant slowing in economic activity? In other words… is the rally in the bond market a short-term or longer-term phenomenon?

According to a Goldman Sachs report published last week the action within the crude oil futures market between late April and late May represented a drastic change in expectations for future inventory levels. At the end of April the markets were anticipating a gradual decline in inventories back to 5-year average levels but as prices declined and forward length contracted the view shifted a month later to an ongoing build.

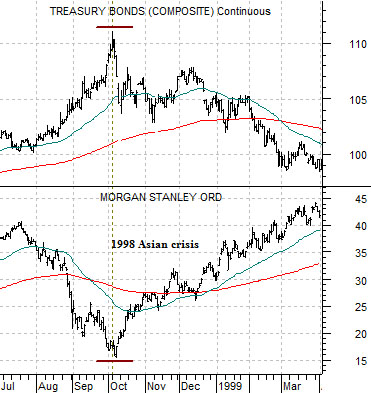

Below we show a comparison between the U.S. 30-year T-Bond futures and the share price of Morgan Stanley (MS) from 1998- 99. Through the Asian crisis in the late summer of 1998 the bond market surged higher as money moved away from risk. MS declined from around 40 down very close to 15 through the crisis only to pivot back to the upside regaining all lost ground once the long end of the bond market began to work lower.

Below we compare the U.S. 30-year T-Bond futures with the share price of Goldman Sachs (GS) from the current time period.

Obviously GS hasn’t managed to lose more than half of its market value between March and June but the basic reaction is similar to 1998 as bond prices have surged higher in response to a fairly concentrated move by capital away from risk.

Our argument has been that as long as the TBond futures are not making new highs then there is a reasonable chance that the equity markets are working through a bottom. This scenario was holding together quite nicely into the end of last week but was stressed considerably by the reaction to the U.S. employment data coupled with the emergence of problems once again in Hungary.

One potential outcome this month would be a spike to new highs for the bond market similar to early October of 1998 as GS fails back below 135. If this is a temporary event then a decline by the TBonds back below the 50-day e.m.a. line (roughly 121) might be enough to signal the start of a more bullish equity markets trend.

Equity/Bond Markets

Below we show a fairly long-term comparison between copper futures and the ratio between the share prices of FreePort McMoRan (FCX) and JP MorganChase (JPM).

The argument is that when the trend for copper prices is higher the ratio between FCX and JPM will move upwards. In other words one is better off being long the base metals miners rather than the banks when copper prices are pushing upwards.

Further below we show the same comparison over a shorter time frame.

The point is that if copper prices are set to decline after recently breaking below the 200-day e.m.a. line then the trend towards strength for the miners versus the banks reverses back in favor of the banks. While weaker copper prices typically represent slowing cyclical growth the chart suggests at least the potential for a bullish outcome if the banks show enough strength to offset the weakness in the basic materials stocks.

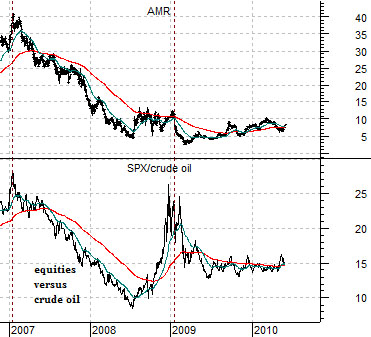

Lastly is a chart comparison between the share price of U.S. airline AMR (AMR) and the ratio between the S&P 500 Index (SPX) and crude oil futures.

This is likely pure imagination but we were pondering what might happen within the markets as an offset to cyclical weakness. When the Nasdaq and capital spending collapsed post-2000 the offset was a positive trend for home prices which helped stimulate consumer spending. With the real estate sector still under pressure we wondered whether energy prices might act as an offset by declining to much lower levels than most believe possible. Just a thought .

When the equity markets are stronger than energy prices (i.e. a rising SPX/crude oil ratio) the airlines (and autos) are capable of trending higher. After more than a decade of a trend dominated by upward pressure on energy prices and downward pressure on the autos and airlines it may be time to look for something different. We will have to keep an eye on the SPX/crude oil ratio in the days to come in case it starts making new recovery highs with AMR swinging back above 10.50.