Yesterday was, in many ways, quite a strange trading session. The U.S. dollar ended broadly higher even as the commodity price-sensitive Canadian dollar rose against the greenback. Metals prices weakened and for much of the day it felt as if energy price weakness was creating something of a positive pivot for the energy ‘user’ sector. Yet by day’s end WTI, gasoline, and Brent crude oil futures closed higher.

Meanwhile bond prices declined as yields held within the recent trading range while the equity markets shifted from higher to lower as the day progressed. Much ado about very little or… the start of something new?

If yesterday marked some sort of trend change away from the relentless rise in energy prices then the best that we can argue is that it was… subtle. So subtle, in fact, that it was almost impossible to see on anything but a very short-term chart. Still, in keeping with our tendency to be ‘ever hopeful’ we are going to start off with a single chart comparison on this page to show what we were looking at.

Below is a comparative view of the share price of Carnival Cruise Lines (CCL) and the ratio between Brent crude oil futures and the CRB Index.

The argument is that CCL is trending down within a channel as an offset to the relative price strength of Brent crude oil. As long as CCL is working lower the markets are effectively ‘saying’ that there is no end in sight for oil and gasoline price strength. Fair enough.

The trend had a very quick ‘shake’ back in January as CCL broke out through the channel top concurrent with the Brent/CRB Index falling below the resistance line. Almost immediately the old trend was reasserted due, we suspect, to the shifting of crisis perception over from Libya to Iran.

This is probably a good relationship to keep a close eye on over the coming days because CCL is struggling with support in the 29 range after having crossed from channel bottom to channel top by simply moving sideways from August through February. It would take very little from current levels to punch CCL through the top of the channel which, in our view, would indicate that Brent crude oil futures are ready to take a breather after 14 consecutive months of relative price strength.

Equity/Bond Markets

Over the past number of years an assortment of markets have been trending higher as an offset to the never ending series of concerns pressuring the financial markets. Notable amongst these were the Swiss franc, Japanese yen, gold, and long-term bond prices.

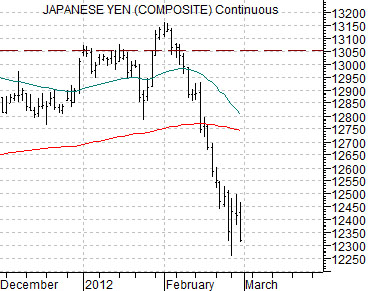

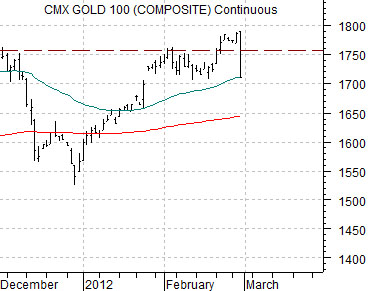

We have argued on occasion that a true pivot back into recovery will require weakness in most- if not all- of these markets. The Swiss franc buckled last year while silver prices peaked in April of 2011 followed in August by gold prices. The Japanese yen staged a most impressive pivot back to the down side last month but we are still waiting on the bond market and… the next slide for gold prices.

The chart below is of the Japanese yen futures while at middle right is a view of gold futures.

The argument a few days back was that the gold chart might be setting up for a ‘break out failure’ after new recovery highs were reached in late February. We explained that these kinds of moves tend to be quite dramatic since the shorts have been forced to cover by the push through resistance even as the speculative longs pile back onto the band wagon. Hopefully gold’s price volatility yesterday made our point somewhat clearer.

Below is a chart of 10-year Treasury yields and the ratio between Alcoa (AA) and Newmont (NEM).

There are two arguments that stem from this chart. First, recent peaks for yields have occurred when the AA/NEM ratio has risen to roughly .32. (i.e. substantially above today’s levels). Second, the positive swings in 2010 and 2011 lasted for close to 9 months.

The point? We have a hard time viewing gold price weakness as anything but bullish for the recovery. If history were to be kind enough to repeat and assuming that the AA/NEM ratio does not tip back to the downside in the interim… the next cyclical peak appears to be some months off into the future.