As of yesterday the Fed funds futures were forecasting a 0% probability of any change in the funds rate following this month’s Federal Open Market Committee meeting. Some argue, in fact, that we may not see the first rate hike until some time in 2011.

We spent much of the latter part of 2003 arguing that the Fed was holding rates too low for too long and introduced the idea in early 2004 that strength in energy prices would force the Fed to increase short-term interest rates. We recall making the preposterous assertion around March of 2004 that crude oil futures prices could rise as high as 75. Given that oil prices were closer to 35 at the time… that was quite a stretch.

In any event… we are not going to suggest that the Fed should be raising interest rates this month but we can show that based on the last few cycles it actually might make sense for them to initiate the process.

Below is a comparison between the Fed funds target rate and U.S. 30-year T-Bond futures from October of 1999 through June of 2001.

The Fed made its first cut in the funds rate in January of 2001. The chart shows that this was almost exactly twelve months AFTER the long end of the bond market began to rise in price. In other words the markets pushed bond prices up and long-term yields down for a full year before the Fed decided that it was time to start getting busy.

Also below we have included the same comparison for April of 2003 through the end of 2004.

The first rate hike following the tech and telecom ‘bust’ took place in June of 2004- almost exactly one year AFTER the bond market had peaked in price. The market had been pushing long-term interest rates higher for a full year before the Fed realized that it was time to start tightening credit conditions.

So… there are two points that we wish to make from these charts today. First, through the last two cycles the markets have led the Fed by very close to one year. Second, contrary to what one might think… bond prices began to decline with yields moving higher as soon as the Fed began to lower the funds rate in 2001 and bond prices started to rise with yields falling lower in the face of a higher funds rate in 2004. We will continue with this below.

Equity/Bond Markets

If one doesn’t stop and think about the final point that we made on today’s first page it might slide right by. Since it is important we are going to repeat it. Long-term yields rose when the Fed cut short-term yields in 2001. Long-term yields fell when the Fed increased short-term yields in 2004.

Below is the same chart comparison for the current time period. Notice that the bond market has been trending lower in price as long-term yields have risen for just over one year. If history were to repeat- exactly- the Fed would be set to raise the funds rate this month which would, in turn, help lift long-term bond prices back to the upside.

In a sense we are being somewhat unfair when we even hint that the Fed is slow to react to markets conditions. The Fed, after all, is simply a follower. The markets generally tell the Fed when the time is appropriate to alter the interest rate for over night money.

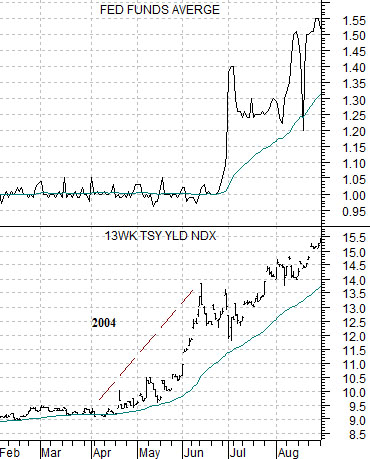

Below we compare the Fed funds target rate with U.S. 3-month TBill yields from 2004.

The key detail here is that TBill yields began to rise a month or two before the Fed increased the funds rate from 1% to 1.25%. In effect the markets ‘said’ prior to the June meeting that it was time to begin the tightening process.

Now consider the chart below. The funds target rate is between 0% and .25% while TBill yields are still trading close to .05%. Our expectation is that the Fed will make no changes to the funds rate later this month simply because the markets have yet to indicate that it is time to do so.