The basic markets trend over the past few years has been quite similar. Through the first half of the year commodity prices and long-term Treasury yields have risen while the final six months of the year has featured falling energy and metals prices and lower long-term interest rates.

The point, we suppose, is that the first half of 2009 commodity prices, cyclical growth, and long-term yields have clearly pushed higher but if history were to be kind enough to repeat the final two quarters of the year will include an entirely different sort of trend.

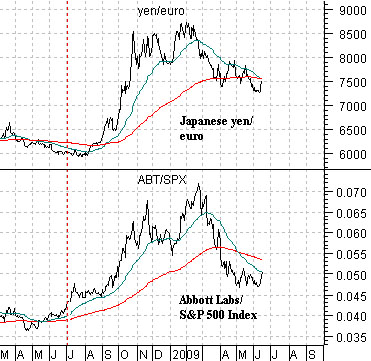

Belowwe compare the cross rate between Japan’s yen against the euro along with the ratio between Abbott Labs (ABT) and the S&P 500 Index (SPX).

The trend through the back half of 2008 favored the yen over the euro and the consumer and health care defensives relative to the broad market. While it is too early to call this a trend change the action over the past few sessions has favored both the yen and the defensive stocks.

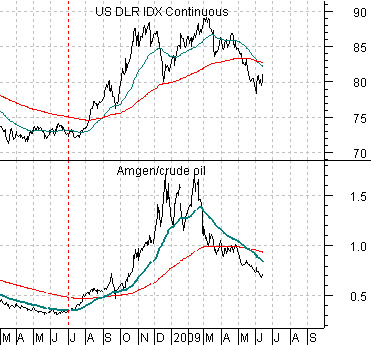

Below we compare the U.S. Dollar Index (DXY) futures and the ratio between the share price of Amgen (AMGN) and crude oil futures.

We have argued that strength in AMGN tends to show up at or near dollar bottoms and given the tendency for crude oil prices to rise when the dollar is weaker we constructed the AMGN/crude oil ratio as a proxy for the dollar’s trend. The ratio bottomed out in June of last year just ahead of the dollar’s ascent.

The point that we are working towards is that we are approaching the end of this year’s second quarter with crude oil, copper, the Asian equity markets, and long-term yields near the highs. If the trend is going to reverse- as was the case in 2006, 2007, and 2008- then we would look for dollar and bond market strength and a shift within the equity markets away from the commodity producers back towards the consumer defensive and health care names. We are paying particular attention to the minor price changes in the share prices of Amgen, Abbott, Johnson and Johnson, Coca Cola, Pepsi, and Wal Mart while remaining ‘ever hopeful’ that this trend will develop and expand to a point where it takes Boston Scientific along for the ride as well. When energy prices start to actually weaken our focus will shift over to the energy-using sectors that include the autos and the airlines.

Belowwe compare, from bottom to top, the ratio between the Amex Oil Index (XOI) and S&P 500 Index (SPX), the ratio between Canada’s S&P/TSX Composite Index (TSX) and the SPX, and the ratio between Wells Fargo (WFC) and Canada’s Royal Bank (RY).

The idea is that when the oils break down relative to the broad market (falling XOI/SPX ratio) this should go with relative weakness by the Cdn stock market (falling TSX/SPX ratio), and relative weakness by Cdn banks compared to U.S. banks (rising WFC/RY ratio).

In trading yesterday the TSX fell 2.3%, the XOI was off 1.7%, while the SPX was down only .14%. This pushed the XOI/SPX and TSX/SPX ratios lower. The only problem for our thesis was the weakness in Wells Fargo following the credit downgrade. Other than that it was a fairly good day for our thesis.

Below we compare copper futures with the yield spread or difference between 10-year and 3-month Treasury yields.

We have been using 2.20 as key support for copper futures. The idea is that if copper prices are lower bond prices will be higher which will result in a declining yield spread. The simple point is that copper and long-term yields tend to trend together so as long as copper prices are strong and rising there is little chance that the trend that has dominated the markets since the end of last year has changed.

Below we have included a chart comparison between the ratio of the share prices of Johnson and Johnson (JNJ) and FreePort McMoRan (FCX) along with the sum of the price of the U.S. 30-year T-Bond futures and U.S. Dollar Index (DXY).

The argument is that any time the dollar AND the bond market are stronger the equity markets trend will favor consumer defensive names like JNJ over commodity cyclical stocks like FCX. The minor rally this month in the bond market and dollar has helped to push the JNJ/FCX ratio marginally higher.