To start things off today we return to a chart comparison that we have shown in these pages on quite a number of occasions in the past. The chart shows 10-year U.S. Treasury yields (TNX) and the ratio between the share price of Coca Cola (KO) and copper futures.

The basic argument has been that over the past few years the underlying trend has flip-flopped from strong to weak cyclical growth around the half-way point for the year. Through the first six months Treasury yields have risen as the Coke/copper ratio has declined and then through the back half of the year interest rates have fallen as the share price of Coke has risen relative to copper futures.

If the pattern had held through 2009 we would have expected to see a rising trend for 10-year Treasury yields from January through June as the Coke/copper ratio moved lower followed by a return to falling interest rates in July as the Coke/copper ratio moved upwards.

The chart below shows the relationship over a shorter time frame. We have argued- quite often, actually- that as long as 10-year Treasury yields hold below the highs set in June we aren’t inclined to relegate this view to the proverbial scrap heap. The thought is that while the Coke/copper ratio clearly did not make a bottom in June it may simply be storing up momentum similar to a beach ball pushed below the surface of the water. In other words after a full quarter’s worth of delay we will end up with a concentrated reaction that should run through into the end of the year.

To get the ball rolling, however, 10-year Treasury yields have to break down through the rising support line that has helped define the trend for economic recovery since December of last year. Given that yields ended trading yesterday almost exactly on the support line it wouldn’t take much more than a close below 3.3% to indicate that the markets are swinging back to a more defensive theme even as many traders are long growth-oriented assets in the expectation or, perhaps, hope that the trend will hold through the end of the quarter.

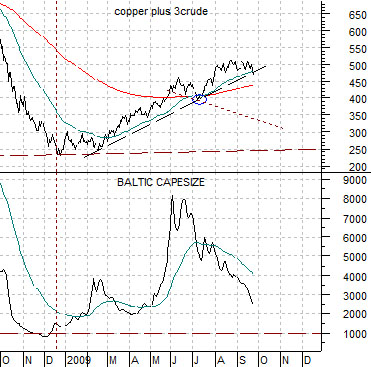

Our argument has been that weakness in ocean shipping rates along with a marked lack of strength in long-term Treasury yields opens up the potential for an imminent theme change- one that would favor the large cap consumer and health care names at the expense of the BRIC-related cyclical sectors.

Below is a chart of the CRB Index along with the ratio between Coca Cola (KO) and the S&P 500 Index (SPX) from 1980 into 1988. We thought that we take another run at this argument given the recent weakness in the commodities sector.

The cyclical theme was dominated by rising commodity prices into 1980 and as the CRB Index peaked the ratio between Coke and the S&P 500 Index bottomed.

Between 1980 and 1986 the trend was led by large cap consumer growth names as the KO/SPX ratio pushed to the upside.

In 1986 the trend shifted from consumer back to cyclical as the CRB Index bottomed and the KO/SPX ratio topped. The return of cyclical strength pushed interest rates higher through 1987 ultimately creating enough pressure to ‘crash’ the stock markets. However, while commodity prices were on the rise the dominant theme was Japan which, in our view, represents a consumer cyclical instead of commodity cyclical.

To get from a commodity-driven theme to a consumer cyclical theme took more than 5 years of relative price strength by the consumer growth stocks. For those who recall the early 1980’s were ruled by Peter Lynch and the Fidelity Magellan Fund as investors mired in the past stuck with the oils, mines, gold, and steel stocks while Mr. Lynch made hay with obscure doughnut chains.

Our point is that we are at least part way through the process with the KO/SPX ratio (chart at bottom right) pushing upwards for the past three years. Our thought is that we should still see another year or two of new highs for this ratio as commodity prices remain under pressure.

Quickly… the Baltic Capesize Index rose marginally yesterday but remains far below the highs of last June. To the extent that ocean freight rates for dry bulk cargo trend with copper and crude oil prices we can make a case for lower interest rates and falling energy and metals prices through the final quarter of 2009.