March 22 (Bloomberg) — The U.S. House passed the most sweeping health-care legislation in four decades, rewriting the rules governing medical industries and ensuring that tens of millions of uninsured Americans will get medical coverage.

Our first thought late Sunday following the passage of U.S. health-care reform was that the trend had changed. The flow of money that had previously been directed out from the U.S. towards foreign markets and commodity-based themes had come to an end. The Hong Kong stock market was in the process of losing a couple of percent, the markets were worried about monetary tightening in India, and the dollar was firm.

Our second thought was that, in fact, nothing had changed. In other words the trend had no reason to change simply because it had done so during the fourth quarter of last year. The market’s reaction was not an indication of shift in the flow of capital but instead a confirmation of something had already taken place.

Below is a comparison between the U.S. Dollar Index (DXY) futures and U.S. 3-month TBill yields.

Whether one pegs the change in trend in November or some time during the second half of October the argument is that the weak dollar/falling short-term interest rates trend that marked the start of last year’s fourth quarter turned into a stronger dollar/rising short-term yields trend on the way out.

Next we compare the share price of Canadian airline WestJet (WJA) and crude oil futures.

We are using WJA to represent the broader non-energy cyclical theme. We could use any one of a number of airlines as well consumer growth names such as Wal Mart but this should suffice for the time being.

The trend shifted back in October as crude oil futures prices rose above 80. This marked the start of a rising trend for the energy ‘users’ to reflect the market’s perception that crude oil prices were going to remain flat to lower in response to the stronger dollar. As long as energy prices remain relatively well contained, the dollar’s corrections hold at the moving average lines, and WJA continues to resolve higher the argument is that the U.S. economy is improving and in due course TBill yields will rise above .25% to mark the start of a series of increases in the funds rate by the Federal Reserve.

We have been working on two themes in recent days. The first was laid out on page 1 today and includes a stronger dollar, rising short-term interest rates, and a flat trend for energy prices.

The second theme revolves around Japanese asset prices. Our thought is that the more determined the Bank of Japan is to inflate real asset prices the stronger the trend for financial asset prices.

Below is a comparison between Hong Kong’s Hang Seng Index and the ratio between the share prices of Panasonic (PC) and FreePort McMoRan (FCX).

PC is a consumer cyclical while FCX is a commodity cyclical. The argument here is that the ratio is working as a mirror image of the trend for the Hang Seng. Why? Largely because the Asian theme (which, in large part, is represented by Asia ex-Japan) is related to construction, infrastructure, base metals, iron ore, ocean freight rates, etc.

If the PC/FCX ratio rises when the Hong Kong stock market declines then to get to a better trend for Japanese equities it would appear that a softer trend in the Hang Seng would be helpful.

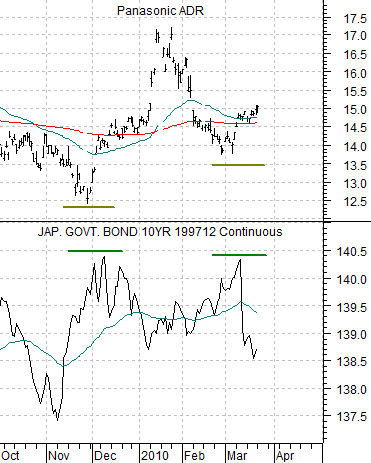

Below we compare PC with the Japanese 10-year (JGB) bond futures. The argument is that PC will tend to rise when Japanese bond prices are falling (and vice versa).

We are going to return to a chart that we showed in yesterday’s issue. Below is a chart of the ratio between 10-year Japanese and 10-year U.S. bond PRICES.

From 1990 into 2000 the ratio rose as Japanese long-term interest rates declined relative to U.S. yields. From 2000 to the present day the trend reversed as U.S. yields were pulled down towards Japanese yields. Our thought is that one of two things could happen now. The ratio could break to the upside or… it could continue to decline. If it declines then it will do so either through weakness (falling U.S. yields similar to 2007- 2008) or strength (rising Japanese yields). We know what ‘weakness’ can lead to (carnage, chaos, rising gold prices, etc.) but the ‘strength’ outcome would be specifically positive for Japanese equities.