ATLANTA -(Dow Jones)- The U.S. Federal Reserve must be open to raising interest rates to pop future asset bubbles, even though stronger regulation remains the best solution to prevent a repeat of the crisis, the Fed chief said Sunday.

As we work back and forth through the various markets we get the sense that there is almost no stance- bullish or bearish- that provides us with much in the way of comfort. When economic growth is driven by rising asset prices while central banks work to ‘pop’ asset price bubbles the future appears rife with boom and bust cycles. Being long a speculative market is always a nervous proposition, being on the sidelines as others make profits is mentally wearing, while standing in front of a runaway trend on the short side is fiscally disastrous. We suspect that 2010 will start strongly and end badly. If we were to make a prediction for the year ahead that would likely be it.

Below we compare the U.S. 30-year T-Bond futures with the spread or difference between 10-year and 3-month Treasury yields.

The yield data for the charts only dates back to 1994 but through the past decade and a half the spread between 10-year and 3-month yields has never risen above roughly 3.8%. In other words we ended 2009 with the spread at levels that have tended to mark reasonably significant bond PRICE bottoms. The chart makes the case that on those instances where the spread rose to around 3.8% a bounce for bond prices quickly followed.

The spread can narrow or decline in one of two ways- either through lower long-term yields or higher short-term yields. The market is saying, in a sense, that if long-term yields continue to rise then the Fed does not have to be ‘open’ to raising interest rates but instead has to actually start to do so within the next couple of months.

The chart below shows the combination of the U.S. 30-year T-Bond futures times the Japanese yen futures. Both the TBonds and the yen have been ‘contrary’ markets rising as economic growth has slowed. As long as the combination of the TBonds times the yen continues to walk up the rising trend line that began back in mid-2007 our sense is that cyclical growth still has the potential to surprise to the down side. All of which means that we start off the new year with the bond market very close to price support within a trend that began back in 2007 that has, time and again, featured rather disquieting asset price collapses.

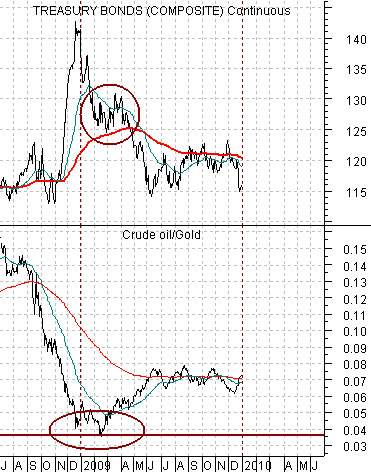

We are going to return to a series of chart comparisons that we showed on these pages on quite a few occasions through 2009. The charts are based on the relationship between the bond market and the ratio between crude oil and gold prices.

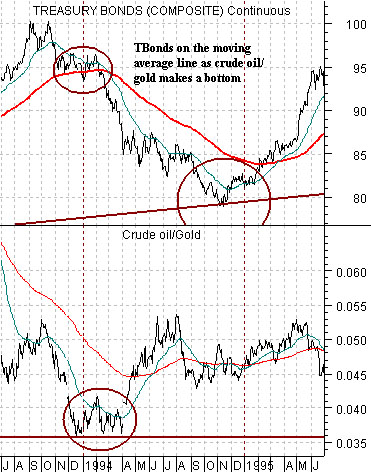

The chart below is from 1993- 95. It compares the U.S. 30-year T-Bond futures with the crude oil/gold ratio with our focus on what happened during 1994.

The argument was that when the crude oil/gold ratio made bottom around the start of 1994 the TBonds were testing the 200-day e.m.a. line. As the bond market declined in price through the balance of the year the ratio pushed back to the upside.

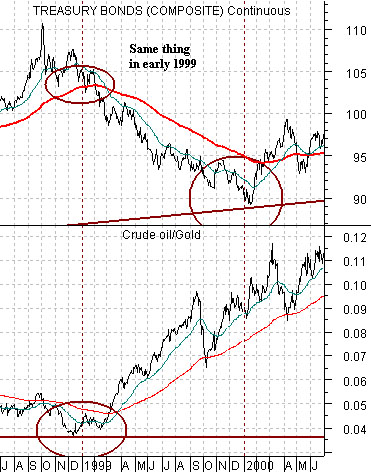

The same comparison is shown below from 1998- 2000. Once again the low point for the crude oil/gold ratio was reached as the TBonds flirted with the moving average line in early 1999. As bond prices declined through 1999 the ratio moved upwards.

For the third time since 1994 the markets set up in the same fashion early in 2009. The crude oil/gold ratio fell to just above .035:1, the TBonds were dancing on the moving average line, and while many believed that a global recession would drive bond prices higher… prices declined as oil prices rose relative to gold prices.

The point? Aside from the observation that within the next quarter or so we should be back to a bond ‘bull’ market (if history repeats) the bond price bottom in 1995 led into a huge equity bull market while the same set up in 2000 preceded a multi-year equity bear market. 2010 should be a year for significant trend changes although the nature and direction of those changes remain somewhat open to question.