We are going to circle back and take one last run at an argument that we introduced in yesterday’s issue.

Belowwe feature a comparison between short and long-term Japanese debt futures (3-month euro yen futures and 10-year Japanese bond (JGB) futures) from mid-2005 to the present time period.

The argument is that no matter what else happens in the world the key for higher Japanese asset prices and improved growth lies with the long end of the Japanese bond market. When Japanese bond prices are declining growth is positive and when bond prices are rising growth is negative.

In early 2006 short-term Japanese debt prices began to fall as short-term Japanese interest rates began to rise. After years of holding to a zero interest rate policy the Bank of Japan allowed short-term yields to move upwards but as we can see on the chart the long end of the Japanese bond market began to rise. In other words… short-term yields rose, long-term yields declined, and Japanese asset prices came under pressure.

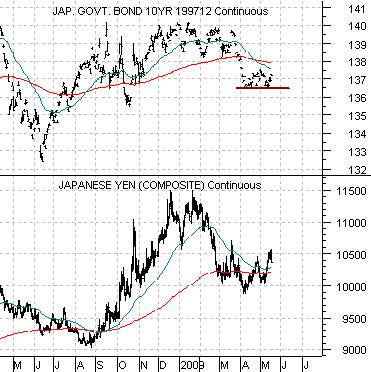

The chart below compares the Japanese yen futures with 10-year JGB futures.

After close to two decades of relative underperformance it is difficult to argue that Japanese asset prices have finally reached ‘the turn’ but our point was that we could justify just such an event if- and only if- two criteria are met. The criteria are a rising yen as well as falling long-term Japanese bond prices.

The general view at present is that yen strength is a negative for Japan’s export-based economy and that could well be true. Our point is that it will be a negative if the offset to a stronger yen is rising bond prices. To the extent that Japanese bond prices continue to decline in the face of a stronger yen then we have an intermarket set up worth paying attention to.

In the days to come the yen may weaken and Japanese bond prices may, in fact, rise but we thought we would attempt to explain how a specific set of markets reactions could lead to a most unexpected outcome.

Equity/Bond Markets

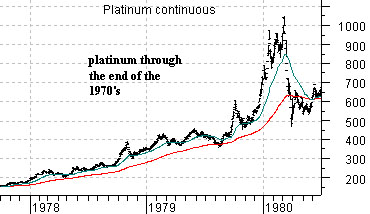

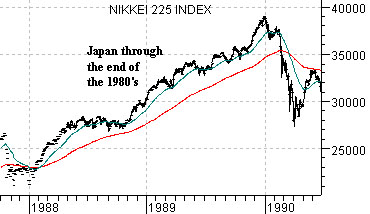

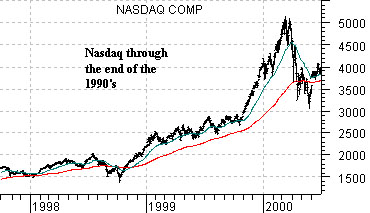

Below we compare a chart of platinum futures through the end of the 1970’s with a chart of Japan’s Nikkei 225 Index from the end of the 1980’s and the Nasdaq Composite Index from the late 1990’s.

Through the last few decades we have seen a number of significant asset price peaks. Commodity prices rise sharply into 1980, the Nikkei put in a major top in 1990, and the Nasdaq reached a bubble peak into 2000.

The first point would be that if the markets went commodities then Japan and then tech followed by a return to commodities… perhaps it isn’t such a stretch to be thinking about Japan once again.

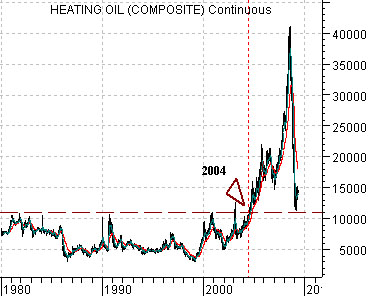

The second point has to do with the chart below of heating oil futures.

When commodity prices reached a peak in 1980- 81 it set a high for energy prices that held all the way through into 2004. Heating oil futures finally made new highs in 2004 rising to a new peak in 2008 before collapsing all the way back to the original break out point near 1.10.

While heating oil futures made new highs in 2004 the chart shows that the rising trend began off of the bottom made back in 1999. In other words after reaching a cycle peak in 1980- 81 commodity prices remained under pressure for close to 20 years before finally turning higher in 1999 to initiate the start of a new positive cycle that would run for close to a decade into 2008.

The third point would be that the trends that dominated through the 1980’s and 1990’s were offsets to weaker commodity prices. Downward pressure on commodity prices helped lower interest rates and expand stock valuations while contained raw materials costs allowed for rising profits for finished goods producers.

The fourth point is that the two themes that followed the peak for commodity prices in the early 1980’s were financial assets (stocks and bonds) and ‘consumer’. Keep in mind that between the peak for platinum futures in 1980 and the eventual peak for the Nikkei in 1990 a full decade elapsed and, as our charts show, the most spectacular part of the trend occurred during its final few years.