Oct. 12 (Bloomberg) — The smallest stock price swings and fastest economic growth in three years are convincing options traders that developing-nation equities are safer than ever relative to U.S. shares.

Let’s jump to our conclusion before we actually make our point today. There is a reasonable chance that the current trend will continue until the CBOE Volatility Index (VIX) declines to the ‘10’ level with risk increasing once it crosses back above ‘15’.

There are any number of ways to look at the markets but one that makes sense to us focuses on the direction of capital relative to the Asian and emerging markets themes.

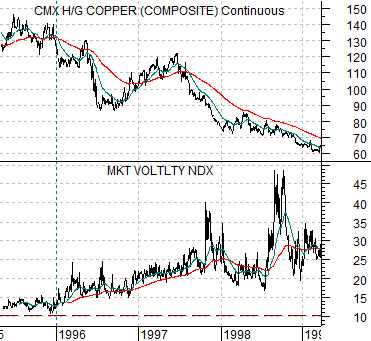

Just below is a chart comparison of copper futures and the VIX from 1995 into early 1999.

The trend for copper prices represents the same basic theme as the commodity currencies as well as the Latin, Asian, and emerging markets. The VIX, on the other hand, trends inversely to copper prices. The end result is a gradual decline in the VIX as money moves away from the dollar and into the smaller niche markets that typically represent ‘risk’.

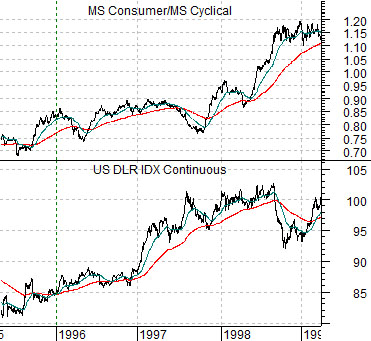

The next chart compares the U.S. Dollar Index (DXY) futures with the ratio between the Morgan Stanley Consumer Index and M.S. Cyclical Index. This chart covers the same time period as the copper and VIX comparison above.

Our first point is that all four markets work in a broad sort of relationship. When copper prices are strong and rising the VIX is falling. Strong copper prices go with money moving away from the dollar which creates a downward tilt for the green back. At the same time this leads to strength in the equity markets in the cyclical sectors so that the consumer/cyclical ratio moves lower.

In 1995 copper prices reached a peak with the VIX trading between 10 and 15. This marked the low point for the dollar and the bottom for the consumer/cyclical ratio. While 1995 was actually the start of a broad U.S. equity bull market powered by the consumer sector the argument is that it represented a trend change away from the Latin, Asian, and emerging markets themes that ultimately ended with the Asian crisis in 1998.

Equity/Bond Markets

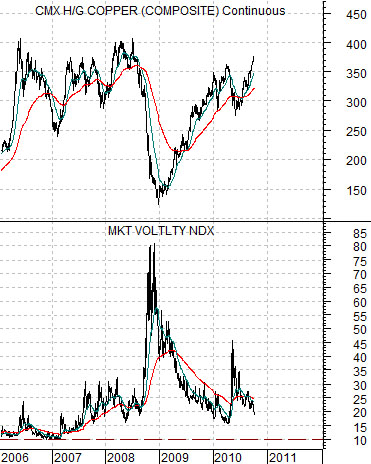

Below we show the same two charts that we featured on page 1. The charts cover the time period between the start of 2006 and the present day.

So… strong copper prices go with a falling VIX. Notice on the chart at top right that the peak for copper futures prices in 2006 occurred as the VIX reached a bottom.

If copper prices begin to weaken confirmed by a rising VIX then the offset is supposed to be a stronger dollar and a rising consumer/cyclical ratio. In a sense this may have been ‘the problem’ back in 2007 and 2008 as copper prices peaked at the 4.00 level and the VIX began to rise even as the dollar continued to decline.

Our point, we suppose, is that in a world without ‘positive drivers’ the path of least resistance for prices has to be lower. If the markets are trading strictly on the Asian/Latin/emerging markets themes and these sectors are no longer pushing higher then chances are that prices have to decline.

The chart below right shows that in mid-2008 the markets finally began to trend in a more ‘normal’ fashion. In a sense the parabolic rise in crude oil futures prices from 2007 into 2008 helped hold the dollar lower until energy prices finally began to weaken. This led to a sharp rise in the dollar and a powerful upward push in the consumer/cyclical ratio.

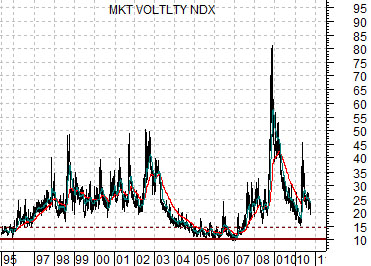

Further below is a chart of the VIX from 1995 into 2010.

Last seen the VIX was just below 20 after peaking in late 2008 just north of 80. The chart makes the case that major bottoms for the VIX tend to be associated with time periods when the index is trading below 15 for an extended period of time. If the VIX bottoms when copper prices are peaking then the argument would be that the current trend has some time left to run as money continues to shift away from the dollar and the stable consumer sectors and into currencies like the Brazilian real, Mexican peso, and Australian dollar.

For the time being the trend remains positive for ‘risk’ as copper prices strengthen and the VIX declines. This should help to keep the dollar under pressure while favoring the cyclical sectors. If history were to repeat our concerns should start to increase once copper prices turn lower and the VIX begins to rise.