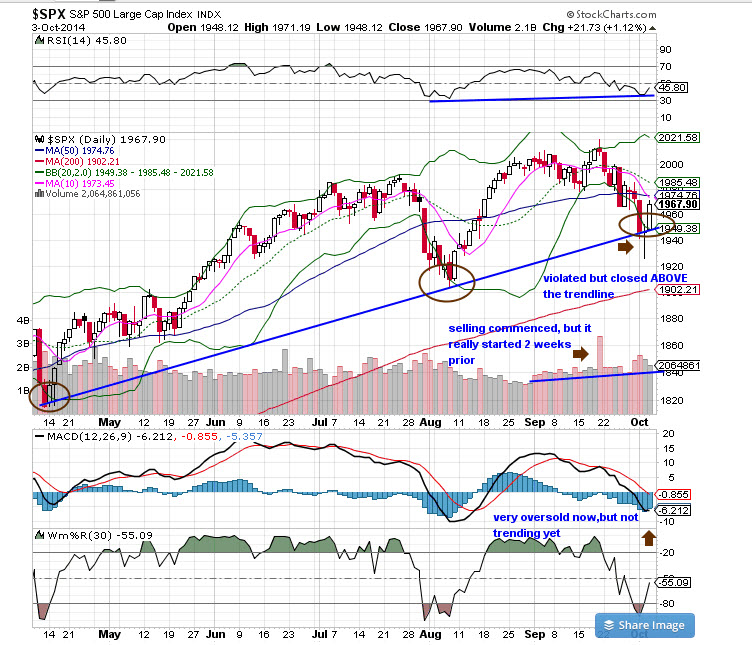

SPX 500 Daily Chart

This past week we saw price touch/violate the uptrend line, in place since earlier this year. That shows us a higher low may be in place. Friday’s action is a good start for a reversal but make no mistake we are still in the middle of corrective action. However, the previous corrections have been short in duration. The market is oversold on several metrics that I follow and can certainly bounce in the interim but unless 1985 is re-captured and exceeded we may have a bearish condition persist. Earnings season is right around the corner.

SPX 500 Weekly Chart

I see little wrong with this weekly chart, the candle here is similar to five prior hammers (marked) that launched the market to the next level. The %R shows an excellent bull retest (red arrow) for the next time frame.

Dow Industrials Daily Chart

All of the indices have different overall patterns but the theme is the same – correction territory. That doesn’t mean it’s the end of the bull market, rather it could just a breather before another run ensues. Different patterns are everywhere – death crosses, hindenberg omens, moving average breaks. But on the Industrials I see a potential inverse head/shoulders (a bit sloppy but fits the pattern) with the neckline around 17,200.

VIX Daily Chart

There is a great pattern to follow here with spike peaks. My good friend Larry McMillan at www.optionstrategist.com has noted this repeatedly and shares his experiences with this strong and very powerful patterns. Problem is, they correct so quickly! notice the circled peaks and the few days it takes to get momentum back down. You really need to be ready for it or you’ll miss out.

XIV Daily Chart

Last week, I had a webinar with Jay Wolberg of www.tradingvolatility.net, and we talked about the XIV (inverse VIX short term ETN) and how it signals great buying and selling opportunities. Jay emphasized the 200 ma was a great spot where price reversals have occurred with consistency (circled). While the range is large (relatively speaking) it seems that Friday’s move up is a good start.

SPX Bullish Percent Index Daily Chart

This chart represents a breadth indicator based on the number of stocks on Point & Figure buy signals within an index. The BPI is a straightforward indicator with clearly defined signals. Here we see the numbers have moved sharply lower but may have now planted a low which on three previous occasions spawned a strong rally in markets.