Chinese equities, as represented by the iShares China 25 Index ETF (FXI) had a strong November performance as the ETF bounced off the 200-day moving average as support.

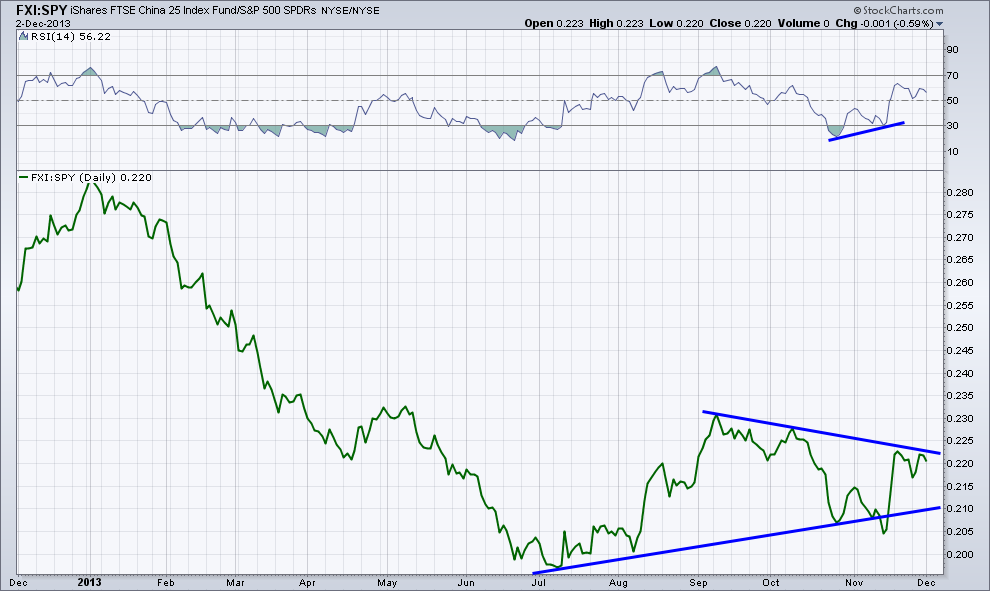

On November 13th I tweeted a chart of the relative performance of FXI and the S&P 500 (SPY). There appeared to be a positive divergence in momentum being created which was bullish for the Chinese ETF. What made this divergence in the Relative Strength Index interested was it was happening at the same time as the relationship between FXI and SPY broke its short-term trend line. We can now see that it was a false break as China’s outperformance pushed the ratio back above the trend line and headed higher through the rest of the month.

Today we can take another look at the relative performance relationship between this international ETF and the domestic U.S. large cap fund. We are able to draw a trend line off the September and October highs to create a trend line which is currently acting as resistance. For China to continue its strength against U.S. equities, we need to see this trend line broken to the upside.

I would also like to see the Relative Strength Index momentum indicator confirm the move if we test the Sept/Oct highs as a sign of confirmation that FXI can continue to lead SPY. If things break down then it’s likely we get a test of the rising trend line off the July and October lows. Since we’ve already had one break of this support level, it’s possible a future test could weaken support further and lead to a break to the downside.

Patience is key right now and we must allow price action to play this out to see if we get an established up trend or down trend for Chinese stocks.

= = =

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.