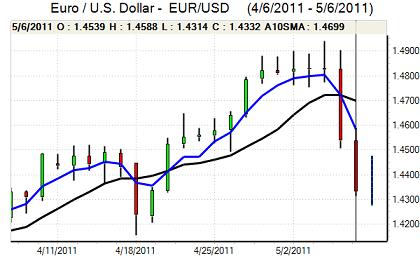

EUR/USD

The Euro hit resistance above 1.4570 against the dollar ahead of the US employment report on Friday and drifted weaker back towards 1.45 ahead of the release.

The headline non-farm payroll increase was higher than expected at 244,000 for April following an upwardly-revised 221,000 gain the previous month while the unemployment rate rose to 9.0% from 8.8% as the workforce increased. There was firm private-sector job gains, but government employment continued to decline. The data did help boost confidence in the economy, but there was still unease over the spate of recent weaker than expected indicators and US Treasury bond yields rose only slightly.

There was choppy trading following the payroll release with fluctuations around the 1.45 level. Later in the New York session, the Euro suffered renewed sharp losses with a low close to 1.43, the weakest level since mid April.

The Euro was damaged by media reports that an emergency EU meeting was being held on Friday and that Greece was considering a withdrawal from the Euro. European officials conformed that a meeting was being held on Friday, but strongly denied that Greece was considering abandoning the Euro.

Following the meeting, reports suggested that the Euro-zone would look at fresh loan packages for Greece, especially as it may not be possible to regain market access during 2012 with the possible need for fresh collateral. There were also reports that the IMF will state that Greece is substantially behind schedule on meeting budget cuts which will reinforce political tensions within Germany and undermine Euro confidence.

Relief that Greece was still in the Euro area allowed a Euro recovery back to the 1.44 area on Monday with the Euro also gaining some ground on yield considerations, but the Euro was still unsettled by fresh contagion fears.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below 80 against the yen ahead of the US payroll data on Friday and the stronger than expected data triggered an initial relief rally in the US currency with a spike to near the 81 level as US yields also rose. The dollar was unable to sustain the gains as yields also weakened later in the US session.

Risk appetite remained generally more fragile following a sharp decline in commodity prices over the preceding 48 hours and there was greater caution over carry trades which curbed selling pressure on the Japanese currency.

The US-China trade talks will be watched closely over the following few days and any evidence that a faster rate of yuan appreciation will be tolerated by China would provide some degree of yen support.

Sterling

Sterling weakened following the US payroll report, but found support close to the 1.6350 level and pushed to a peak near 1.6450 in choppy trading conditions before retreating back to the 1.6350 area again as the dollar secured fresh gains. The UK currency continued to recover against the Euro.

The CBI downgraded its GDP growth forecast for the next two years which will maintain expectations that the economy will remain weaker in the short term.

There will be persistent doubts surrounding the outlook for consumer spending which will reinforce a lack of yield support.

International developments will need to be watched very closely in the short term and the UK currency will continue to gain some important protection from persistent fears over the dollar and Euro. The equation could, however, change rapidly if there are further stresses surrounding the UK banking sector, especially as the main banks have already reported fresh losses on provisions against PPI compensation claims.

Swiss franc

The dollar found support below 0.87 against the franc on Friday and spiked higher to a peak near the 0.88 level. The US currency also gained fresh support late in the US session as the Euro came under fresh selling pressure before consolidating near 0.8750.

The Swiss currency inevitably advanced against the Euro following fresh rumours that Greece was considering leaving the Euro area with a peak just stronger than 1.26 on renewed fears that there could be an increase in capital flight from the Euro area.

Safe-haven considerations will continue to dominate in the short term, especially if there is further volatility in commodity prices.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

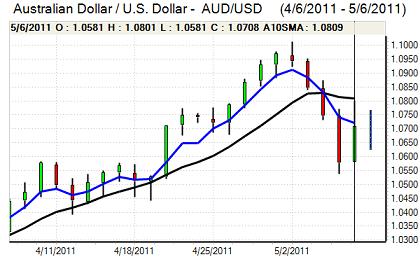

Australian dollar

The Australian dollar found support on dips to the 1.0650 area against the US dollar on Friday with a peak near 1.0775 and after a renewed test of support later in the US session, the currency advanced back to 1.0770 in Asia on Monday.

The currency remained very sensitive to changes in commodity prices, but also found support from existing yield spreads, especially with fresh speculation that the Reserve Bank could consider a further increase in interest rates. Business confidence was little changed in the latest survey which did not have a major impact on the currency market.