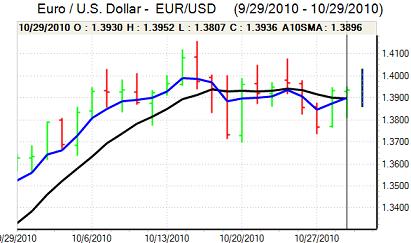

EUR/USD

The dollar held broadly steady ahead of the US GDP data on Friday with markets reluctant to make any aggressive plays given the risk of volatility in the New York session.

Within the Euro-zone, leaders agreed that a new debt-crisis mechanism should be put in place by 2013 and this would be designed to lessen the risk of another Greek-style crisis. Overall confidence in the medium-term outlook will remain very fragile given the debt profile and any serious markets stresses could easily overwhelm official support.

The US third-quarter GDP advance reading was in line with expectations at an annualised rate of 2.0% with firmer consumer spending. The headline inflation reading was also in line with estimates, but there was a core reading of only 0.8% which reinforced market speculation that the Federal Reserve would have scope for additional monetary easing.

The Chicago PMI index was stronger than expected at above the 60 level, but the dollar was unable to make any progress and weakened steadily to test support levels beyond 1.39 against the Euro.

There was further dollar weakness in Asia on Monday with a peak close to 1.40 due to increased speculation that the Fed will adopt a more aggressive policy and the whole outlook for monetary policy is continuing to fan a longer-term lack of confidence in the dollar.

Caution was, however, evident in the options market with greater demand for Euro puts and this will make it difficult for the Euro to sustain much progress. Choppy trading will remain a key threat ahead of Wednesday’s FOMC meeting.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to gain any support following the US GDP data with a decline in US Treasury yields hampering the US currency. The US currency lost further support in early Asia on Monday with a test of fresh 15-year lows near 80.20.

The dollar then spiked higher with a peak close to 81.60 against the Japanese currency. Inevitably, the price action raised speculation over Bank of Japan intervention, but there were also reports that the move was due to a technical error and the dollar lost support very quickly.

The Chinese PMI data was firm which should offer some degree of support to risk appetite and may increase yen selling to some extent with a flow into high-yield currencies, although there will also be additional pressure for stronger Asian currencies. The dollar consolidated just above the 80.50 level.

Sterling

Sterling maintained a solid tone against the dollar ahead of the US data on Friday and then pushed firmly ahead with a high close to the 1.60 level. As the US currency remained under pressure, the UK currency moved decisively above 1.60 in Asia on Monday.

Sterling is continuing to gain support from reduced expectations that the Bank of England will move to additional quantitative easing in the short term. Markets will watch the latest business-confidence surveys very closely this week as they will be very important for underlying expectations and firm readings would further ease near-term pressure for more central bank action.

Sterling volatility levels are liable to remain higher in the short term with the Federal Reserve, Bank of England and ECB all making interest rate decisions this week.

Swiss franc

The dollar was unable to sustain a move above 0.99 against the Swiss franc on Friday and weakened to test support levels near 0.98 following the GDP data. The franc maintained a slightly softer tone on the crosses which made it easier for the US dollar to hold support levels.

An improvement in risk appetite and longer-term hopes for a more effective Euro-zone debt-crisis mechanism will tend to stifle defensive Swiss franc demand in the short term. There will still be a high degree of concern over potential longer-term G7 policies that lead to currency debasement and this will tend to limit selling pressure on the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

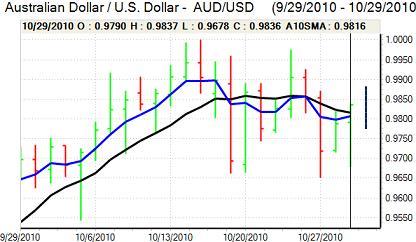

Australian dollar

The Australian dollar found support below 0.97 against the US currency in Europe on Friday and advanced steadily following the US data with a move back to the 0.98 area as the US currency came under renewed selling pressure.

The currency drew further support from an improvement in risk appetite during Asian trading on Monday with a high near 0.89 following solid Chinese PMI data. Domestically, the manufacturing PMI index remained below the 50 expansion threshold for October which will maintain unease over domestic trends. The currency will still spike higher if the Reserve Bank increases interest rates at the Tuesday meeting.