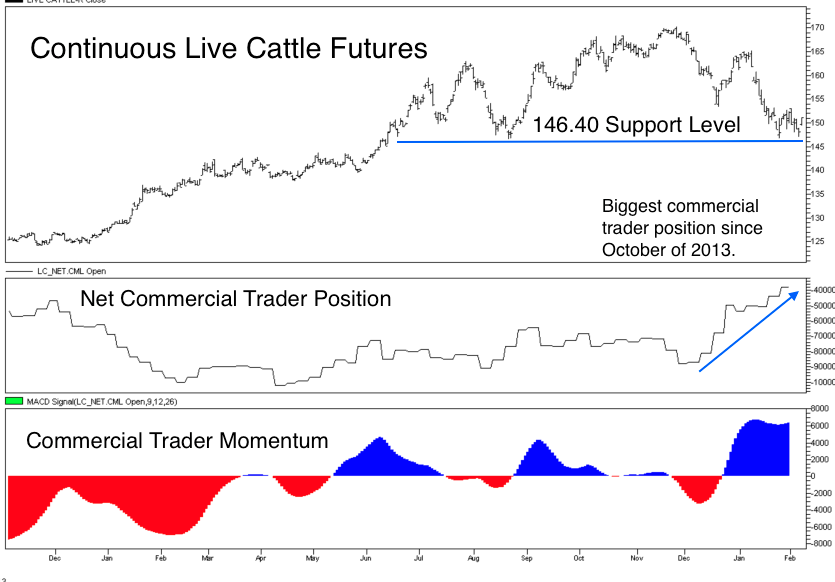

The live cattle futures market has been driven by overseas demand and declining domestic supplies. The broader news regarding generational lows in herd sizes has been offset a bit by the domestic decline in U.S. red meat consumption, which probably set another record low for 2014. The cattle market has been in a multi-year uptrend and is finally providing a meaningful test of the market’s support. We’ve outlined the major support at $146.40 on the chart below. You can see that this support goes all the way back to last June.

This decline has brought commercial end-users out to shop. Their purchases since the beginning of December have been enough to put the commercial trader momentum squarely into the bullish side of things. They’ve purchased nearly 50,000 contracts on this market’s decline. Their purchase of 18,000 contracts, which came on the market’s first test of $153, was the most committed buying we’ve seen from the commercial traders in one week since September of 2013.

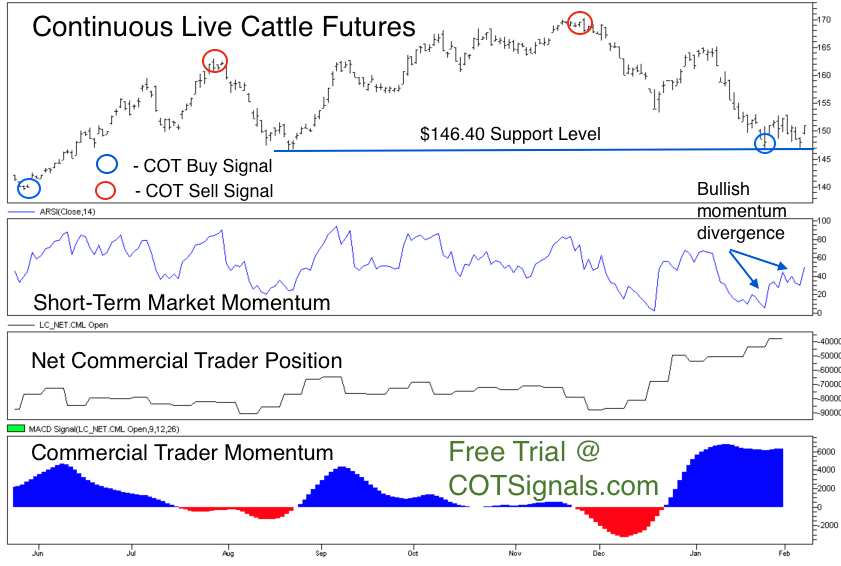

The committed buying on behalf of the commercial long-hedgers at these prices has also created a classic bullish divergence which has led to a COT Buy signal in the April live cattle market. You can see in the chart below that we’ve included our proprietary short-term momentum indicator.

This indicator registered a much higher reading on Thursday’s trade than the reading on January 28th in spite of the trading lows for the 28th and Thursday being within approximately $.30 points of each other. Technically speaking, it’s an insignificant price difference percentage wise in the futures, but the difference in the momentum indicator is a reading of 5.8 on the 28th vs a reading over 50, currently.

Using this divergence and support around the $146 level, the COT program has issued a buy signal for April live cattle futures as long as the low holds above $146.87. The market closed Friday at $151.02.

For more from Andy Waldcock at cotsignals.com, please click here.