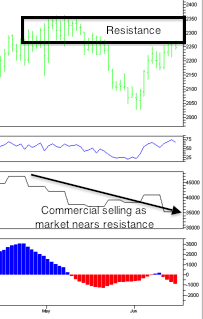

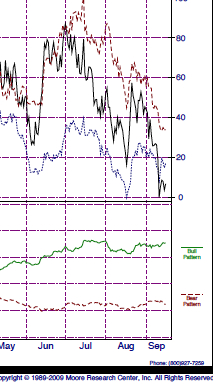

The cocoa market is exhibiting classic commercial trader behavior. Commercials were buyers in April near the $2050 per ton lows and now that the market has come back to test the $2275-$2350 area, commercial traders have turned sellers. Last week’s Commitment of Traders Report shows that commercial traders sold nearly 5,000 contracts, 12.5% of their total position.

They clearly expect the resistance to hold and the market to exhibit its typical seasonal price decline from July, 1st – expiration of the September contract. COT Signals is selling September Cocoa and placing our protective buy stop above the recent swing high of $2271.

ANDREW WALDOCK

866-990-0777

This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed as to the accuracy, and is not to be construed as representation by Commodity & Derivative Adv. The risk of trading futures and options can be substantial. Each investor must consider whether this is a suitable investment. Past performance is not indicative of future results.