The crude oil market has been digesting excess supply due to Iranian oil flowing east, rather than west and the Saudi’s filling the westward supply gap. See Global Glut Going Nowhere.

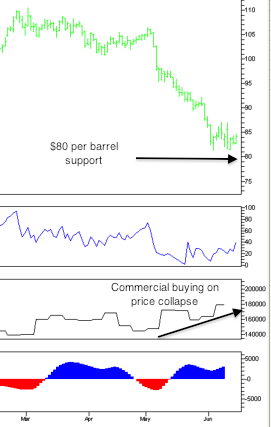

The market finally gave way to fundamentals and fell after spending March and April above $100 per barrel. Like most markets, swings tend to go too far in either direction and that is what we’re seeing now.

Commercial traders have been active buyers below $90 per barrel and I expect this to continue. We will be buying August crude oil futures and placing a protective sell stop below the swing low of $81.39.

ANDREW WALDOCK

866-990-0777

This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed as to the accuracy, and is not to be construed as representation by Commodity & Derivative Adv. The risk of trading futures and options can be substantial. Each investor must consider whether this is a suitable investment. Past performance is not indicative of future results