August 23, 2012

This trade setup is merely a random sample of the day’s trades generated by COT Signals. To track our work their and receive all of our nightly trading recommendations.

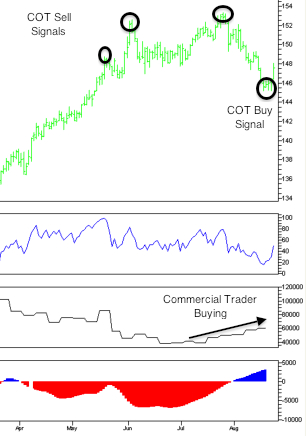

This morning we have a buy signal in the 30yr Bond futures. Commercial traders were major buyers coming off of the March lows and finally started to shed their positions as the market climbed above 148. Their selling patter became quite clear as the market stalled between May and June before finally selling off in July and August. Commercial traders are now actively re-purchasing contracts.

This also ties in with the sell signal we posted yesterday in the Dow futures. We expect bond futures to rally as money finds its way into safe havens in anticipation of an equity sell off. Finally, the Federal Reserve Board minutes seem to be pointing towards QE3. This will further depress yields and lead to greater price gains in the futures.

We will buy bonds and place a protective stop below the swing low at 145^08.

ANDREW WALDOCK

866-990-0777

This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed as to the accuracy, and is not to be construed as representation by Commodity & Derivative Adv. The risk of trading futures and options can be substantial. Each investor must consider whether this is a suitable investment. Past performance is not indicative of future results.