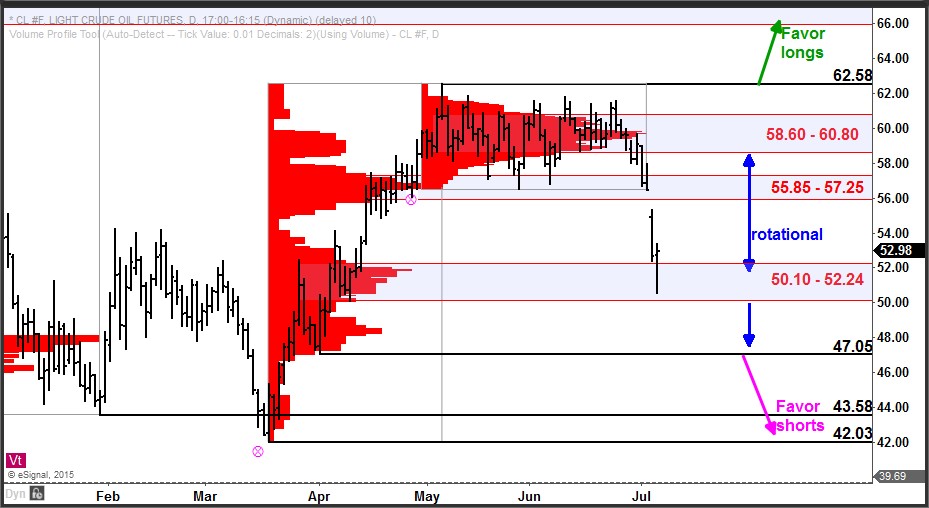

Crude oil spent nearly two full months oscillating between $56 and $62 per barrel and now, in two sessions, has declined to touch $50.58.

So where’s it going?

It has reached its next lower zone of support at 50.10 – 52.24 and has already begun to bounce.

This support zone was established over 3 months ago as a significant zone and following the breach of the 55.85 – 57.25 support zone, which held for weeks, traders in-the-know didn’t relent on selling crude until it hit this next lower support.

There is now a substantial zone of resistance left above at 58.60 – 60.80, which is not likely to be easily overcome on any rally attempt.

This leaves crude oil in a zone of rotation between support at 50.10 – 52.24 (with additional support below at 47.05 – 48.00) and resistance at 58.60 – 60.24.

There will be no reason to even think about crude oil prices going higher while the resistance zone at 58.60 – 60.80 remains intact.

The momentum in the short-term is to the downside but as prices have reached initial support, it’s not unlikely that crude will at least pause, bounce, or potentially begin a new range of rotation between the new support and resistance zones.

There is no technical analysis tool or method for finding support and resistance that is superior to volume-at-price information. If you’d like to see more about how to use volume profile analysis in your trading, visit here.