The most liquid and traded commodities in the world are without a doubt oil and gold.

Given the great importance that both gold and oil play on a global scale, these two commodities exhibit a strong bonding with certain currencies. Specifically, some of the countries that are aggressive exporters or large importers of physical goods as well as countries with big mines or oil wells will have their currencies heavily influenced by fluctuations in commodity markets.

Oil and gold can easily be associated with many countries in the world, however in this article we will focus on two major exchange rates—the Japanese yen and the Australian dollar.

The reasons these two currencies have been selected are straightforward— Japan is an aggressive exporter and its industrial production rate is amongst the highest in the world. Australia has very large mines and it exports raw metals and minerals worldwide.

CRUDE OIL CORRELATIONS

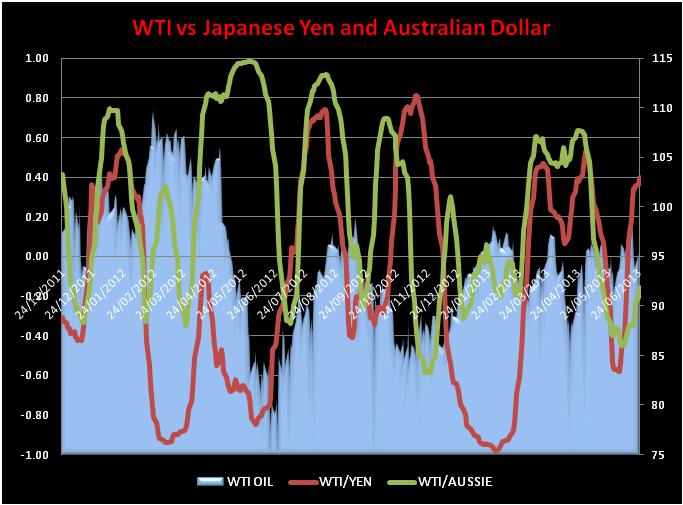

The first asset class we will examine is West Texas Intermediate (WTI) crude oil. Figure 1 plots the correlation among WTI oil, Japanese Yen and Australian dollar futures.

The correlation analysis displays that WTI futures prices tend to be more correlated to the fluctuations of the Australian dollar than to the ones experienced by the Japanese yen.

Specifically, the relationship WTI/Australian dollar averages around +0.23 whilst the rapport WTI/yen is usually negative -0.17.

This means that WTI futures tend to move more like the Australian dollar does but their fluctuations are almost opposed to oscillations in the Japanese yen. This makes sense because the Asian currency is often used as a hedging tool by market players who will consequentially buy yen when the WTI plummets.

GOLD MARKET CORRELATIONS

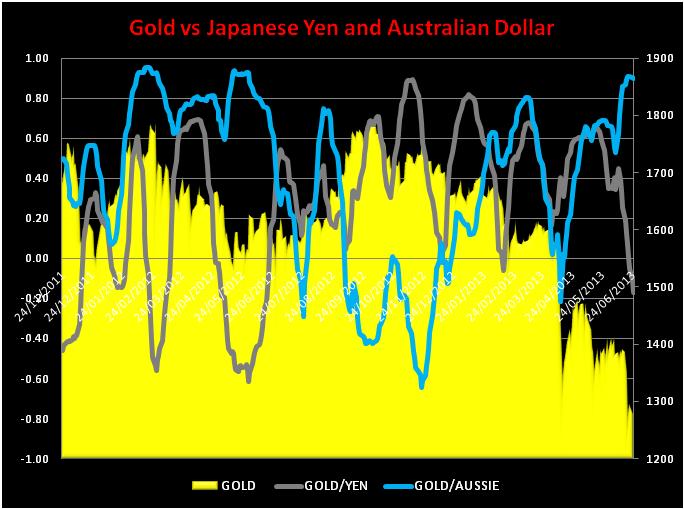

Let’s now have a look at gold prices and see how its relationship with different currencies behaves.

Gold prices have a more stable and solid connection to Japanese yen and Australian dollars than the WTI. In fact, the average correlation is +0.35 with the yen and +0.51 with the Australian dollar. Gold prices are so tied to Australian dollars because Australia is one of the biggest gold producers in the world, hence, any considerable change in the price of this commodity will heavily influence the oscillation of its currency.

On the other hand, the fairly good relationship with the Japanese yen is a consequence of the fact that gold is often used as a hedging tool (just like the Asian currency) therefore their standard deviation and covariance are going to move symmetrically.

FIVE KEY TAKEAWAYS

There are some good findings in our research that can be used in practice by all traders and market players. Here is a summary (needless to say that the followings are not meant to be trading recommendations but only a general guide):

1) Japanese yen futures are a good hedging tool to hold when WTI oil futures are plummeting.

2) The Australian dollar tends to move along with crude prices so it can be used as an indicator to check the strength of the price trend.

3) Gold prices are well correlated to Australian dollars therefore they tend to move and fluctuate in the same way.

4) Australian dollars are an extremely good indicator for price trend on the gold market and vice versa.

5) Japanese yen futures tend to have a positive relationship with respect to gold prices because both these asset classes are used as hedging tool to reduce portfolio risk.