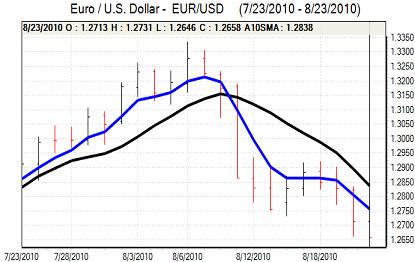

EUR/USD

The Euro held broadly stable in European trading on Monday, but was unable to make any headway above 1.2730 against the dollar as underlying confidence remained fragile and it retreated again in US trading.

Confidence in the global economy remains fragile amid fears over a double-dip recession and risk appetite remains generally weak, especially with commodity prices coming under selling pressure. The Euro’s performance over the past few weeks has continued to be influenced strongly by trends in risk appetite and it has weakened when unease over the global economy has increased. There were also longer-term doubts over the Euro-zone fundamentals.

Technical considerations remained important and the Euro was undermined by the inability to regain previous support levels. In this environment, traders continued to target stop-loss levels in an attempt to trigger further Euro losses.

There were no economic data releases to guide markets and investors were uneasy over the risk of weaker releases over the remainder of this week, especially with expectations that US GDP would be downgraded sharply later in the week.

The Euro weakened to 8-week lows around 1.2620 against the dollar and was unable to secure any significant respite in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was blocked below 85.50 against the yen on Monday as it failed to gain any significant buying support and there was a renewed test of support close to the 85 level. The US currency resisted a decline through this level, but retained a heavy tone.

Fears over the global economy had an important impact in supporting the yen with declines in commodity and stock-market prices undermining risk appetite.

Prime Minister Kan held talks with senior business leaders and Bank of Japan officials during the day to discuss the impact of yen strength. There was inevitably speculation over fresh action to curb yen strength through intervention or monetary measures. With no evidence of direct action, the yen maintained a firm tone with the dollar trapped close to the 85 level.

Sterling

Sterling was unable to sustain a move above 1.56 against the dollar on Monday and quickly retreated back to the 1.5550 area. There were reports from a Bank of England committee that Sterling weakness had been important in keeping underlying inflation at elevated levels, but the UK currency was unable to gain any support.

Sterling was undermined to some extent by persistent weakness in global risk appetite as confidence in the global economy weakened and the impact was magnified by a lack of domestic data releases.

Domestic monetary policy considerations will be very important and markets will remain on high alert over any policy remarks from bank officials.

As the dollar retained a generally firm tone, Sterling weakened to lows near 1.5450 against the dollar, but was close to 8-week highs near 0.8150 against the Euro as there speculation that the Euro-zone monetary framework would remain even looser.

Swiss franc

The Euro found support close to 1.31 against the Swiss franc on Monday and rallied to a high near 1.32 as the currency corrected from recent very sharp losses. In this environment, the dollar was able to make headway against the franc and rose above 1.04 in Asian trading on Tuesday.

There has been some speculation that the National Bank will step-in to avoid heavy franc gains, but the bank will find it very difficult to embark on sustained intervention which will limit the potential impact.

The Swiss currency will also continue to gain background support from defensive demand triggered by a deterioration in risk appetite.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

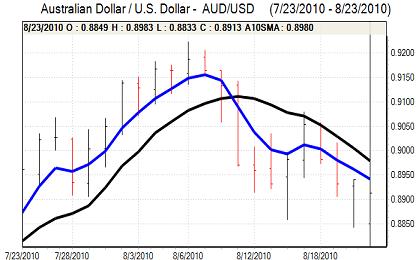

Australian dollar

The Australian dollar strengthened during Tuesday with gains to around 0.8960 against the US currency with relief that initial selling pressure following the election result was contained and optimism that there would not be a damaging impact on economic policies.

The currency will still be vulnerable to some selling pressure if there is a prolonged period of electoral uncertainty.

Risk appetite remained generally weaker and the Australian dollar was then subjected to renewed selling pressure with a low close to 0.8860 as interest in carry trades waned.