Tests Rising Channel Bottom.

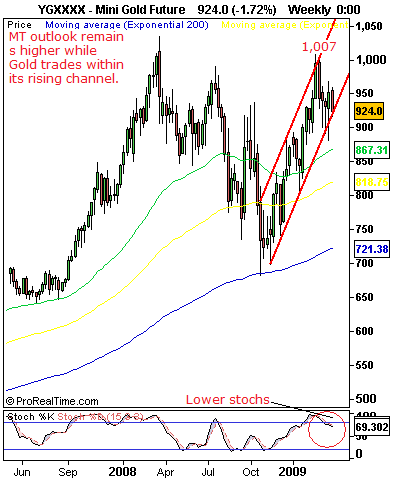

GOLD (Futures): Gold Closed lower at the end of the week taking back most of its previous week gains and testing the bottom of its weekly rising channel currently located at 920.The commodity’s technical outlook remains clearly to the upside as long as the mentioned channel bottom and its weekly low at the 920 level are not violated. In that case, we should see Gold recovering from those losses and retargeting its Mar 23’09 high at 958 with a trade above there accelerating further upside gains towards its Mar 20’09 high at 968.Beyond the latter will leave the 1,000/7 level, marking its psycho level/Feb 20’09 high being targeted and then its 2009 high at 1,033.However,if the 915/20 area is decisively taken out, risk for further declines will open up towards the 881.10 level, which is the location of its Mar 18’09 low followed by the 801.70 level, its Jan 15’09 low. Weekly studies are negative and pointing to the downside supporting this view. We still retain our bias for Gold to continue to maintain within its rising channel and subsequently set off additional upside gains. The bigger risk however in our broader outlook on the pair is a technical pattern (double top)which could be shaping up on the weekly and the monthly timeframes. Lets keep our fingers crossed and see whether this will unfold or not. Aside this threat, medium term trend for Gold remains to the upside.

Weekly Chart: GOLD

This is an excerpt from FXT Commodity Strategist Plus, a 5-commodity (Gold, Silver,Crude Oil,Wheat & Corn)model analysis. Take A One Week Free Trial at www.fxtechstrategy.com

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the financial instruments referred to in this report.