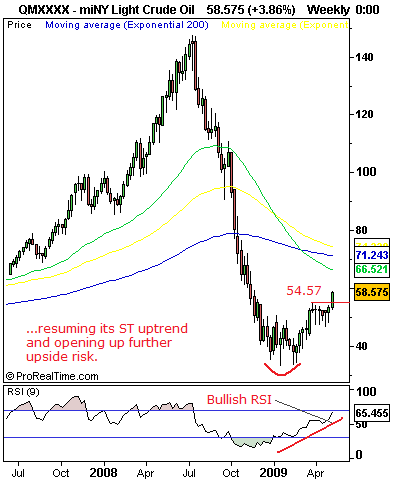

Breaks and Holds The 54.67 Level

CRUDE OIL(Futures): Having hesitated for five weeks since hitting a high of 54.67 on Mar 26’09, Crude Oil cleanly broke and closed above that resistance level the past week to close higher at 58.57.This development has two clear implications with the first being the triggering of its short term uptrend resumption initiated at the 33.55 level ,its double bottom base and the second being the building up of risk for a move higher towards the 65.57 level, its Nov 10’08 high. Breaking and holding above the latter will call for additional upside offensive towards the 71.77 level, representing its Nov 04’08 high. This level also falls within the vicinity of its weekly 200 ema currently at 71.24. Both the weekly stochastics and RSI are positive and pointing higher suggesting further strength. However, pullbacks if seen should trigger declines towards the 54.67 level its Mar 26’09 high which should now reverse roles and provide support. Further down, supports are located at the 50.45 level, its Jan 06’09 high and the 48.80/57 area, its Mar 09’09/Jan 26’09 highs.All in all, with Crude Oil resuming its short term uptrend, risk of further upside gains is likely.