EUR/USD

The Euro was little changed ahead of the New York open on Friday as caution inevitably prevailed ahead of the US employment data with the currency hitting resistance just above the 1.28 level.

The Euro-zone data offered no support for the currency with a sharp 4.8% decline in German factory orders while there was also a fall in retail sales which reinforced a lack of confidence in the Euro-zone outlook.

There were further concerns over weak demand at forthcoming Euro-zone bond auctions, especially after a sharp increase in Spanish yields and confidence surrounding the Greek situation remained very fragile. There were reports that the IMF was losing patience in Greece’s ability to deliver on budget targets and the Czech government stated that it would be better for the country to leave the Euro if EU states were not prepared to provide substantial rescue funds.

The headline US payroll data was stronger than expected with an increase in non-farm payrolls of 200,000 after a revised 100,000 gain the previous month while there was another unemployment decline to 8.5% from 8.7%. There were solid private-sector employment gains with notable expansion in the transport sector which also boosted confidence in the economy. The dollar gained ground following the payroll data and pushed to a fresh 16-month high just beyond 1.27 against the Euro.

There were still cautious comments from Federal Reserve member Dudley who maintained a generally dovish stance on policy and there was also speculation that the Fed would look to block any further significant dollar appreciation due to a potential negative impact on exports.

German Chancellor Merkel and French President Sarkozy will meet again on Monday as they attempt to create a workable package for the deal agreed in December. The latest IMM positioning data registered a further surge in short Euro positions to a record high which will maintain some speculation over a sharp reversal in the currency on short covering. Nevertheless, the Euro remained firmly on the defensive on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar pushed stronger following the US payroll data ad briefly pushed to the 77.30 area against the yen, but it was unable to sustain the gains and retreated sharply back to lows in the 76.80 area late in the US session.

The yen continued to gain traction on the crosses with the Euro at fresh 11-year lows below 98 while Sterling retreated to lows near 118. There was further evidence of underlying capital repatriation from European institutions which supported the Japanese currency.

The latest speculative positioning data recorded a further sharp increase in long yen positions and this will increases speculation that the Bank of Japan could consider fresh intervention to retrain the yen even though this would cause significant friction with the US Treasury.

Sterling

Sterling was unable to make a move above 1.5520 against the dollar on Friday and dipped sharply to lows around 1.5380 during the New York session. A generally firm US dollar was again the principal influence and Sterling held firm against the Euro with a test of resistance in the 0.8220 area.

The Halifax house-price index recorded a 0.9% decline for December following a revised 1.0% dip the previous month, maintaining unease over the housing sector with further evidence of regional divergence.

There was a more confident survey surrounding the financial-services sector which maintained some optimism that the economy might be able to avoid recession with a high degree of uncertainty still the principal consideration. There will be some caution ahead of Thursday’s Bank of England MPC meeting, although the bank traditionally is very reluctant to change policy in January.

Swiss franc

The dollar maintained a strong tone against the Swiss currency on Friday and pushed to a high near the 0.96 level before drifting back to the 0.9550 area. There was a significant move against the Euro as the franc advanced to the 1.2140 area, confounding expectations of strong potential National Bank franc selling in the 1.2150 area.

Swiss consumer prices fell by 0.2% for the second consecutive month in December to give an annual decline on 0.7% and there will be further concerns surrounding deflation within the economy. There was also further speculation that controversy surrounding Bank President Hildebrand would prevent any near-term raising of the Euro’s minimum level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

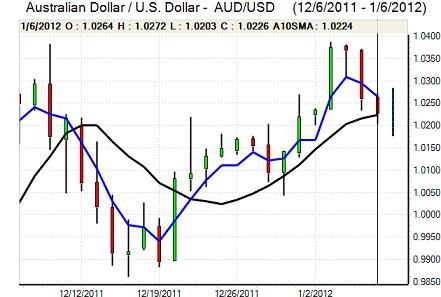

Australian dollar

The Australian dollar hit resistance above 1.0250 against the US dollar during Friday and dipped to lows near 1.0150 early in the Asian session on Monday.

Retail sales were unchanged in December following a 0.2% gain the previous month which was slightly weaker than expected and had some negative impact on the currency.

The Australian dollar was still broadly resilient as there was some greater optimism surrounding the global economy following the US payroll data which had some positive effect on the currency, even though caution tended to prevail.