EUR/USD

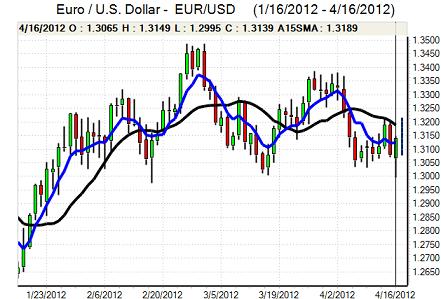

After failing to gain any traction in Asia, the Euro remained under pressure in Europe on Monday and dipped to test support at 1.30 with a brief dip through this level for the first time in two months.

Confidence in Spain continued to deteriorate with a further increase in bond yields to a four-month high while credit-default swaps rose to record highs. There were further fears over the impact of recession and fiscal tightening on the economy. There was additional speculation that the ECB would either have to re-introduce the peripheral bond buying programme or announce a further LTRO operation to provide additional liquidity.

The US retail sales data was slightly stronger than expected with an increase of 0.8% for the headline and core numbers which will maintain a broadly optimistic tone towards consumer spending. In contrast, there was a decline in the latest NAHB housing index to 25 from 28 previously which will increase the focus on Tuesday’s housing-starts data amid suspicion that the sector was slowing.

Rating agency Fitch stated that it was not considering any action on Italian ratings helped stabilise Euro sentiment to some extent. There was also reported heavy sovereign Euro demand at lower levels which also cushioned the currency from further selling pressure. In particular, there were reports that the IMF was buying Euros related to its Euro-zone loan tranches. An initial move higher helped trigger stop-loss Euro demand and the currency was able to push back above the 1.31 level during US trading with a peak near 1.3150.

There will be further caution ahead of Spanish bill-auctions due on Tuesday and bond auctions on Thursday and the Euro edged slightly lower during the Asian session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar initially found support in the 80.50 area against the yen and rallied following the US consumer spending data, but it was unable to push above the 81 level. The currency was subjected to fresh selling pressure during the US session and dipped to lows around 80.35. The Chinese authorities stated that banks could take short speculative dollar positions which undermined the US currency to some extent.

There was also an underlying unease over equity markets which helped provide support for the Japanese currency. Persistent fears surrounding the European sovereign-debt crisis also provided overall yen backing. The US currency was unable to make any headway on Tuesday with markets also remaining on alert over the potential for Bank of Japan verbal intervention.

Sterling

Sterling remained on the defensive against the dollar in European trading on Monday and tested support near 1.58, although there was no major test of support. Wider US dollar trends remained an important influence with Sterling rallying back to the 1.59 level. Sterling initially strengthened to a 19-month high against the Euro before weakening back to the 0.8260 area.

There were no major UK data releases during the day and the latest inflation data may also not have a major influence on Tuesday. The overall policy implications are likely to be limited, although a weaker than expected report would increase the possibility that the Bank of England could move to additional quantitative easing.

Safe-haven considerations will remain important in the short term and there will be the potential for defensive UK currency demand on structural fears surrounding the Euro-zone. Sterling could, however, be vulnerable if there is a sustained deterioration in risk appetite as a focus on banking would be likely to return.

Swiss franc

The dollar pushed to highs around the 0.9240 area against the franc on Monday, but was unable to sustain the advance and retreated back to the 0.9150 region on wider US selling. Despite a rally against the dollar, the Euro was unable to make any headway against the Swiss currency and actually edged lower in US trading.

There will still be unease surrounding the Euro-zone outlook which will tend to push defensive funds into the franc. The latest producer prices data recorded a 0.3% in prices for March which was slightly below expectations and the National Bank will remain on high alert over deflation risks which will also maintain pressure for franc gains to be resisted.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support just above the 1.03 level against the US currency on Monday and rallied back to the 1.0380 region in US trading, although it was still finding it difficult to gain strong support. There was further uncertainty surrounding the Chinese economy which dampened demand and there was a general lack of confidence in commodity currencies which had a negative impact.

The Reserve Bank minutes from April’s meeting stated that it would be prudent to wait for the inflation data before taking action, but that there was scope for lower interest rates. Markets continued to price in a May rate cut and the Australian dollar retreated back to the 1.0320 region against the US currency.