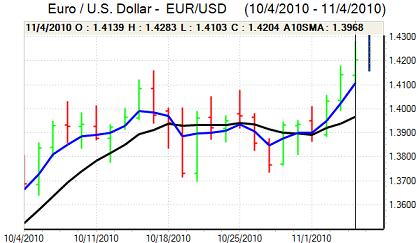

EUR/USD

The dollar was unable to gain any traction in Europe on Thursday and remained under pressure through much of the day. Underlying sentiment remained extremely negative following the Federal Reserve decision to boost quantitative easing the previous day.

The dollar continued to suffer from a lack of yield support and there were heightened fears over a persistently weaker currency in the medium term as a side-effect of the aggressive Fed action to support the economy.

The US economic data did little to improve sentiment as jobless claims rose to 457,000 in the latest week from 437,000 previously, although the underlying measures were more resilient. The latest payroll data will be watched closely on Friday, although the impact may be less than seen in recent months given that the Fed has already made the quantitative move. A stronger than expected figure could trigger a covering of short positions and there may be some scope for investment inflows which would provide support, but it will be difficult to secure a more durable rebound in dollar confidence.

There were no surprises from the ECB as it left interest rates on hold at 1.0%. President Trichet also took a generally hard-line tone with comments that non-standard measures were by nature temporary, reinforcing market speculation that the ECB is looking to make an exit from special measures.

There will still be a high degree of unease over the Euro-zone structural vulnerabilities, especially with yield spreads continuing to widen. There is still the risk that internal stresses will prevent the ECB from tightening policy and confidence in the Euro could deteriorate rapidly.

The Euro pushed to high around 1.4280 against the dollar before retreating to test support near 1.42 late in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support near 80.50 against the yen on Thursday, but was unable to make much headway as the US currency was again hampered by a lack of yield support.

Risk appetite was generally firm during the session with gains for commodity prices and equities which could lead to some yen selling to fund carry trades, although there is still likely to be a generally cautious tone given medium-term fears.

The Bank of Japan left interest rates on hold at 0.00 – 0.10% following the latest council meeting. The bank did expand its asset-buying operations, but there was some disappointment in the overall stance. The dollar dipped briefly following the decision, but recovered to stand little changed around 80.80.

Sterling

Sterling held firm in Europe on Thursday with a monthly recovery in the Halifax house-price index providing some initial currency support.

As expected, the Bank of England left interest rates on hold at 0.50% following the latest MPC meeting and also held the asset-purchases target at GBP200bn. Expectations of any easing had faded considerably following the recent stronger than expected data, but Sterling still gained some initial support from the decision.

There will be a further near-term contrast between the UK stance and Fed decision to expand quantitative easing. The UK currency will also gain protection from fears over the Euro-zone structural vulnerabilities. Sentiment could still deteriorate rapidly if there are signs of a sharper than expected slowdown as fiscal tightening takes effect. Sterling peaked at 2010 highs near 1.63 against the dollar before edging weaker.

Swiss franc

The dollar was unable to secure any recovery against the franc during Thursday and weakened to test support below 0.96 as underlying negative dollar sentiment was compounded by general franc strength on the crosses.

National Bank council member Danthine stated that the bank would be ready to act to counter currency strength if there was a return of deflation risks in the economy, but the comments did not have much of a negative impact on the franc.

The Swiss currency gained renewed support from stresses within the Euro-zone bond markets with the Euro losing ground.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

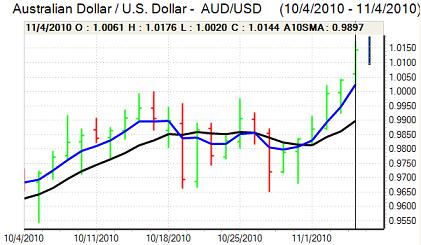

Australian dollar

The Australian dollar has maintained a firm tone over the past 24 hours and pushed to fresh 28-year highs above 1.0150 against the US dollar. The local currency has continued to gain support from generally weak US confidence following the Fed’s move.

There have also been further strong gains for commodity prices which has provided indirect support for the Australian dollar. The construction PMI index remained below the 50 level according to the latest data and concerns over the domestic economy are liable to increase.