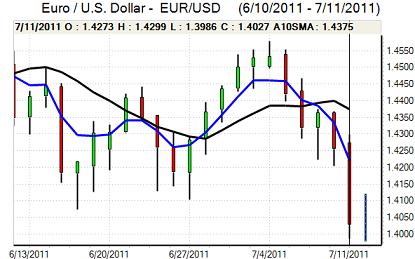

EUR/USD

The Euro was capped close to 1.42 early in the European session on Monday and was then subjected to heavy selling pressure. There was an initial slump to lows just below 1.4050 and after only a limited recovery, the currency dipped to test 7-week lows below 1.40 during US trading.

Confidence in the Euro-zone deteriorated further during the day with a particular focus on Italy and Span as bond yields rose sharply. Italian yields rose to highs near 5.70% which quickly triggered an increase in fears that Italy would be sucked into the sovereign-debt crisis. The debt dynamics remain very serious for Italy given that the debt/GDP ratio is above 120% and that over EUR150bn in debt needs to be rolled-over during the forthcoming 12 months.

Euro-group officials held emergency talks during Monday to discuss the situation and there was some discussions surrounding a potential buying of Greek bonds in the secondary market. There were, however, further serious tensions over potential funding for such a scheme with heavy resistance from Germany to an increase in the rescue fund. Confidence was also damaged by the announcement that Greece substantially missed its budget targets over the first half of 2011.

There were further talks surrounding the US debt ceiling during the day with President Obama talking with senior congressional leaders. There is still resistance to any tax increase by Republicans and market tensions will tend to increase given that the Administration is still insisting that the debt limit would be breached at the beginning of August.

After a brief respite, the Euro came under fresh selling pressure with lows below 1.3950 against the dollar in Asia on Tuesday as risk appetite continued to dominate.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was blocked close to 80.80 against the yen in European trading on Monday and dipped sharply during European trading with lows around 80.30. Risk conditions continued to deteriorate during the day which triggered defensive demand for the Japanese currency with the Euro weakening to 4-month lows below 112.

There were further fears surrounding the Euro-zone contagion threat and there will also be fears surrounding capital repatriation given the potential for a reduction in European holdings by Japanese institutions.

Domestically, there was a modest rebound in the tertiary index and the Bank of Japan left interest rates on hold following the latest policy meeting with a slight upgrading of the economic outlook. The focus, however, remained firmly on the Euro-zone and international contagion risk with the yen advancing to near 80 against the dollar during Asian trading on Tuesday.

Sterling

Sterling was unable to regain the 1.60 level against the US dollar on Monday and retreated to test support below 1.5950. Pressure accelerated as a break of support triggered stop-loss selling and the UK retreated to lows below 1.59 which was a five-month low for the UK currency. Sterling was resilient against the Euro as it strengthened to beyond 0.88.

The RICS house-price index recorded a figure of -27% in June from -28% previously while the BRC reported an annual 0.6% annual decline in like-for-like retail sales. There was some relief over the sales data, but underlying confidence in the economy remained weak.

Bank of England Governor King stated that inflation should fall towards the 2.0% target level over the next few months which reinforced market expectations that interest rates would stay at extremely low levels and undermine yield support.

The banking sector and safe-haven demand dynamics will be extremely important in the short term. Sterling will gain some support while the UK appears insulated from any contagion threat, although any increase in UK tensions would appear quickly through the pressure release of a weaker currency. Sterling continued to trend weaker against the dollar in Asia on Tuesday.

Swiss franc

The Euro was subjected to very heavy selling pressure against the franc on Monday with a rapid decline to fresh record lows below 1.1680 against the franc. In this environment, the dollar was unable to gain any support and retreated to lows near 0.8330 before a partial recovery as fears surrounding Italy intensified.

Safe-haven considerations will continue to dominate in the short term and there will be further defensive franc support when the Euro contagion risk intensifies. There is likely to be renewed focus over possible National Bank action to stem currency appreciation and this is likely to curb speculative franc buying.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

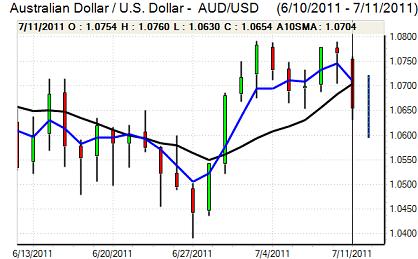

Australian dollar

The Australian dollar was unable to regain the 1.0720 level against the US currency during Monday and retreated sharply during the Europeans session with lows near 1.0630. Risk conditions were the dominant issue with fears over Italian contagion pivotal in increasing selling pressure on the Australian currency, although it was still relatively resilient.

There were also increased fears surrounding the Chinese and wider Asian growth outlook which undermined the currency as commodity prices also fell sharply. In this context, the Australian currency weakened to below 1.06 in local trading on Tuesday with a decline in the NAB business confidence index not having a major impact.