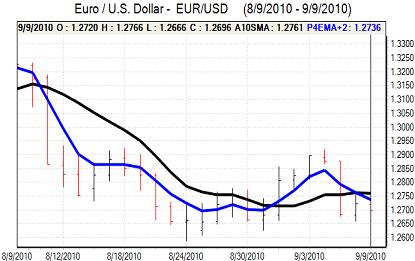

EUR/USD

The Euro was confined to narrower ranges during Thursday as markets were unable to take out any major technical levels.

There were also no major Euro-zone developments during the day, but there was a more measured tone surrounding regional bond markets which helped stem any aggressive Euro selling.

The US jobless claims data was better than expected with a decline to 451,000 in the latest reporting week from a revised 478,000 previously. A further retreat away from the important 500,000 level will increase hopes that labour-market conditions have stabilised following a soft patch during the Summer.

The trade data was also significantly better than expected with a drop in the monthly deficit to US$42.8bn from a revised 49.8bn the previous month. The June and July deficits should probably be seen in combination, but the drop in July imports will help trigger an upgrading of third-quarter US GDP growth forecasts.

Although confidence in the US economy improved slightly following the data, the principal effect was an improvement in international risk appetite with an advance in stock markets and gains for commodity prices. The improved environment surrounding risk also helped underpin the Euro as it challenged resistance levels near 1.2750 against the dollar.

The Euro was unable to break resistance levels and weakened back to the 1.27 area as underlying confidence in the Euro-zone financial sector remained weak.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar continued to find support near 83.50 against the yen during Thursday and attempted to rally following the US data, but it was unable to make significant progress and was blocked below 84.

Official policy actions remained a key focus and the net effect did not provide dollar support. Finance Minister Noda stated that simulations of currency intervention had taken place which suggested that actual intervention could be close.

The credibility of these comments was thrown into doubt by Bank of Japan Governor Shirakawa who stated that the subject had not been discussed at a meeting between the central bank and Finance Ministry.

Markets will remain on high alert, but will certainly question the potential for intervention, especially with G7 pushing for a stronger Chinese yuan and the dollar remained below 84 in early Asia on Friday.

Sterling

Sterling was unable to mount a further challenge on resistance levels above 1.55 against the dollar during Thursday and maintained a generally softer tone.

As expected, the Bank of England held interest rates steady at 0.50% following the latest monetary policy meeting. There was also no change to the quantitative easing amount of GBP200bn. There had been some speculation that the bank could consider a fresh round of quantitative easing at the meeting and the decision to hold rates steady provided some degree of relief for Sterling.

Overall confidence in the economy will, however, still be fragile amid expectations of a slowdown in demand. The latest trade data was also weaker than expected with the shortfall widening to a record GBP8.7bn for July from a revised GBP7.5bn the previous month.

Although the rise in imports will increase speculation over firmer consumer spending, there will also be unease that a competitive currency has not helped narrow the trade gap. In this environment, Sterling was unable to strengthen much above 1.54 against the dollar and also hit resistance close to 0.82 against the Euro.

Swiss franc

The Euro resisted a further slide to record lows during Thursday and consolidated just below 1.29 against the Swiss currency. The dollar found support below 1.01, but it was trapped below 1.02 as dollar buying support remained limited.

Risk appetite was generally firmer following the US data releases which curbed defensive franc demand to some extent, but persistent doubts surrounding the Euro-zone financial sector prevented any major selling pressure on the franc.

Markets will be on alert for any monetary policy remarks by key National Bank officials ahead of next week’s quarterly policy meeting.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

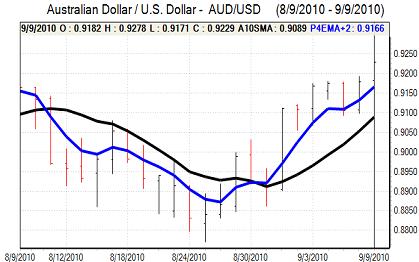

Australian dollar

The Australian dollar continued to draw support from the stronger than expected employment report released during Thursday which reinforced expectations that there could be further interest rate increases within the next few months.

There was also an improvement in global risk appetite which helped underpin confidence in the Australian currency and it pushed to highs above 0.9270 against the US dollar. It was unable to sustain its best levels and drifted back to the 0.9225 area early in the Asian session. There will be some speculation of covert central bank currency sales to slow any further advance.