EUR/USD

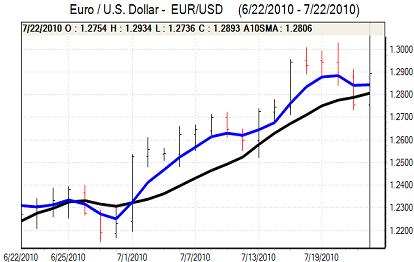

The Euro found support below 1.2750 in early Europe on Thursday and gradually strengthened during the day on domestic and international factors.

The Euro-zone data was stronger than expected which provided some degree of support for the currency. The PMI index for the manufacturing sector strengthened to 56.0 for July from 55.5 the previous month. The industrial orders data was also stronger than expected with a sharp 3.8% monthly increase for May which triggered some improvement in confidence surrounding the manufacturing sector.

Stress tests surrounding the Euro-zone banks will be watched very closely on Friday and there will be rumours of the results during the day. Sentiment may stabilise if there are no major failures, but confidence will be at risk if there are very large capital-injection needs.

The US economic data was mixed during the day, but markets looked to put a positive outlook on the figures. Existing home sales fell less than expected to 5.37mn for June from 5.66mn the previous month as tax credits expired. The jobless claims data was weaker than expected with an increase to 464,000 for the latest week from a revised 427,000.

Risk appetite improved significantly during the US market session as Wall Street advanced strongly and the Euro pushed to a high around 1.2930. There were reports of central bank selling at higher levels and the Euro retreated back to the 1.29 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Domestically, there was a stronger than expected all-industries report for June, but international conditions tended to dominate. Risk conditions remained generally fragile during the Asian session on Thursday with stock-markets generally weaker amid persistent doubts surrounding the global economy.

The dollar lost support close to the 87 level and approached 2010 lows near 86.50 during the Asian session before stabilising.

Risk conditions remained very important during the day and there was a notable improvement in confidence which stemmed yen demand. The dollar was able to recover to the 87 area as Wall Street rose strongly during the US session.

Sterling

Sterling again found support close to 1.5150 against the dollar in early Europe on Thursday and then pushed higher.

The latest UK retail sales data was stronger than expected with a 0.7% monthly increase for June following a revised 0.8% gain the previous month. The data helped maintain expectations of solid consumer spending trends in the near term.

The impact was offset by doubts whether the Bank of England would be in a position to increase interest rates significantly, particularly as fiscal tightening came into effect.

Trends in risk appetite were important and Sterling gained support from a sharp rally in equity markets. The UK currency still tended to under-perform on the crosses due to persistent domestic doubts and was unable to strengthen to above 1.53. There will be renewed selling pressure on Friday if the GDP data is weaker than expected.

Swiss franc

The dollar was blocked just above the 1.05 level against the franc on Thursday and retreated to test 6-month lows just below 1.04 in US trading. The Euro found support close to 1.3350 against the Swiss currency during the day and advanced to 1.3450.

There was some renewed speculation that the National Bank would consider intervention if there were sharp gains for the franc, although the primary trigger for a Euro rally was a wider improvement in risk appetite.

The Euro-zone bank stress tests will be watched closely on Friday and any negative surprises would tend to trigger renewed safe-haven demand for the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

A decline in Australian business confidence will maintain some degree of unease over the domestic economy and there will also be underlying unease over the global economy. These factors will undermine risk appetite and also tend to limit Australian dollar support. There will still be an important degree of protection from reduced support for the US currency.

Risk appetite also improved significantly during the New York session on Friday and the currency pushed to a high around 0.8950 against the US dollar as Wall Street rallied aggressively.