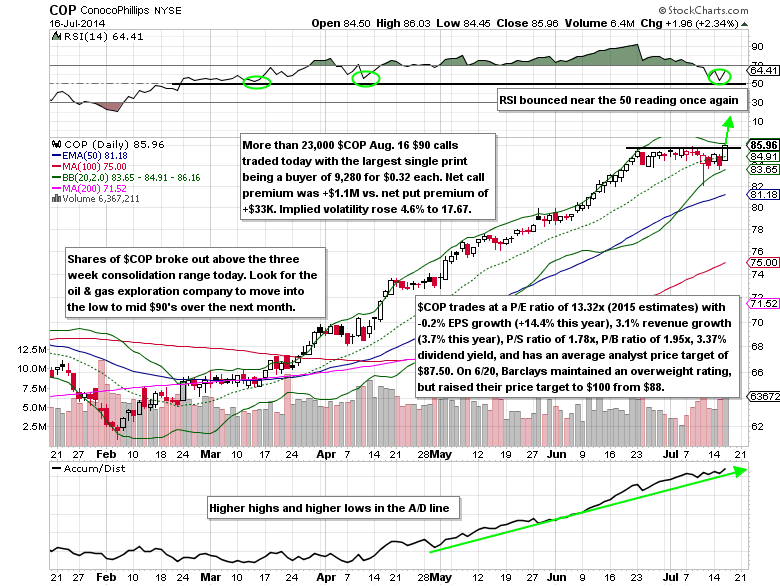

Shares of ConocoPhillips (COP), an oil and gas exploration company are up 25.12% year-to-date compared to the Energy Select Sector SDPR’s (XLE) 14.42% gain (fourth largest weighting in the ETF at 3.9%). ConocoPhillips only trades at a P/E ratio of 13.32x (2015) despite the nice performance with 3.1% revenue growth (3.7% this year). They have a dividend yield of nearly twice that of the Energy ETF (3.37% vs. 1.68%). Barclays (BCS) has been bullish on the stock for more than a year with their overweight rating. On June 20, they raised their price target to $100 from $88 (15% upside potential). ConocoPhillips has topped EPS estimates over the last eight quarters. Revenues increased 5% in Q1, but oil equivalent production soared 49% to 319K barrels per day. Q2 earnings are due out on July 31st.

Bullish Options Activity

On July 16, more than 23,000 Aug 16 $90 calls traded with the largest single print being a buyer of 9,280 for $0.32 each early in the day. On average only 10,988 calls trade per day. Net call premium was +$1.1M vs. net put premium of +$33K. Implied volatility rose 4.6% to 17.67. Just after this activity, call buyers targeted Exxon Mobil (XOM) Aug. 16 $110 calls for $0.19-$0.24 (25,000 total traded). Given that there are others in the sector positioned bullish via call purchases in the same expiration, look for more M&A activity to follow up soon.

Technical Analysis

Shares of ConocoPhillips broke out above the three week consolidation range on the same day as the upside call buying ($85.70 was prior resistance). Look for a move into the low to mid $90’s over the next month based on the technical breakout, valuation and oil production, and unusual options activity.

ConocoPhillips (COP) Options Trade Idea

Buy the Aug. 16 $85 call for $2.25 or better

Stop loss- None

First upside target- $3.50

Second upside target- $6.00

Disclosure: I’m long the Aug. 16 $85 calls for $1.77 each.

= = =