As traders we are always looking for situations with great risk/reward setups. When these setups present themselves it is your responsibility as a trader to “hammer” these setups and trade them with some size to take the most advantage of them. Setups like the one in Las Vegas Sands(LVS) today should be stored in your memory bank so that the next time they present themselves in a stock you make the most out of them.

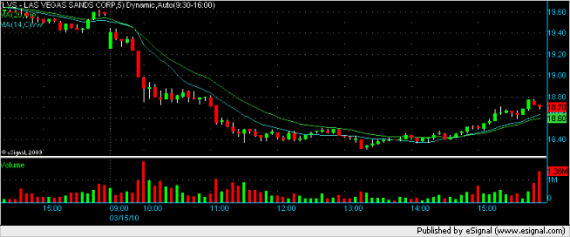

The first thing that put LVS on my radar this morning was the 3-day consolidation pattern on the daily chart. Now my initial bias was to long LVS above this range but I also knew if we broke down from this range that it was a good play. We opened below Fridays range so my bias changed to the short side. I didn’t take the trade right away because we had support at the 2-day low of 19.10 so I was waiting for this level to drop before I put a trade on. This level dropped so I put a small piece on around the 19.10 area.

LVS proceeded to trade down to 19.72 so I took half of my position off. They key here is not exiting the position and moving on to another stock. Never leave a stock if it is doing what it is supposed to do. We pushed up from here to the 18.90 level and every time we got there LVS immediately pushed back down to test the lows. I identified this 18.90 level as a spot to add some size to this trade as a few checks were in my favor. The first check is that we were below a range, the next was the stock had made the move with volume, and the third was I had identified a good risk/reward level. I put on full size the next time LVS got to 18.90 and LVS consolidated for another 20 minutes before breaking down another .40. I scaled 3/4 of the position off into this momentum move and held the rest until LVS broke 18.50 on the upside.

Plays like this should be on every traders radar because any spot that you can limit your risk to a few cents in a stock that is following through should be a trade that you take every time they present themselves. Best of luck in your trading and have a good night.

Kyle

Tagged: day trading blogs, day trading swing trading prop firms, equity prop firm, equity trading, propprietary firms