Just like in one of Aesop’s Fables, “The Tortoise and the Hare,” sticking with the slow and steady can be very rewarding in the end.

The Consumer Staples Select Sector SPDR (XLP) ETF is off 5.27% from its all-time high hit back on May 15. Despite a P/E ratio of around 18, names like Proctor & Gamble (PG) and Coca-Cola (KO)—the two largest weightings in the ETF—are at attractive levels for longer-term investors who are looking to put money to work. In light of the recent market volatility, both of their dividends are back to 3%.

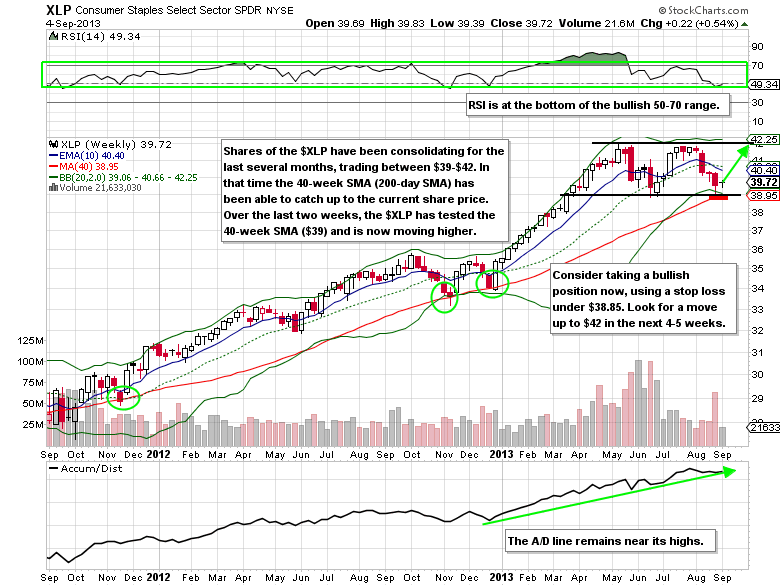

TECHNICALS ON THE CONSUMER STAPLES

Since putting in an all-time high just below $42 in mid-May, shares of the XLP have been trading in a $3 range for the last four months. Due to the passage of time, the 40-week simple moving average (200-day simple moving average) has caught up to the bottom of the current range and is now adding more validity to the major support level. The XLP hasn’t decisively broken through the 40-week SMA in nearly two years and is testing it for only the fourth time since that breach.

OPTIONS TRADE IDEA

Buy: the (XLP) Oct. $40 Call for $0.50 or better

Stop loss: None

Upside target: $2.00