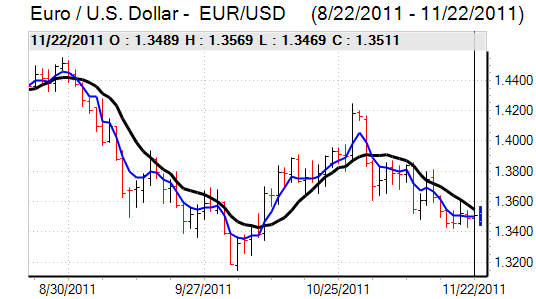

EUR/USD

The Euro was confined to familiar ranges during Tuesday as the currency failed to sustain a move above the 1.3550 area against the dollar and retreated towards the lower end of the range with a particularly sharp decline early in the Asian session on Wednesday.

The IMF launched new support for countries facing difficulties as ‘crisis bystanders’ with an extension of its short-term lending facility. It was not immediately clear whether this would apply to European peripheral economies and the Euro failed to gain sustained support from the announcement, although there was certainly speculation that Italy and Spain could be eligible for funds.

There was further opposition to Eurobonds and the concept of increased ECB bond buying by the German government and key members of the ECB which maintained fears that deadlock would persist as Spanish bond yields moved higher during the day. There were reports that the bailout of Dexia group was in difficulties which further damaged confidence in the financial sector.

There was a further increase in Libor rates during Tuesday and there was continuing evidence of funding stresses within the banking sector. There was further selling of European bonds by key institutions. There was, however, also speculation over further capital repatriation which curbed aggressive selling pressure on the Euro.

The US third-quarter GDP revision was weaker than expected with a decline to 2.0% from the 2.5% original estimate and this had a further negative impact on risk appetite as confidence in the global economy deteriorated again. The Euro retreated to lows just below 1.3450 in Asian trading on Wednesday with the dollar still gaining support from fears over a liquidation of emerging-market holdings and a move back into the US currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to gain nay fresh support against the yen during Tuesday and dipped to lows near 76.85 before clawing back to the 77 area. The disappointing US GDP data prevented any momentum buying for the dollar and there were also concerns that there could still be a credit-rating downgrade within the next few weeks.

Underlying risk appetite remains very fragile and there has been a further downgrading of Asian growth prospects which has maintained underlying defensive demand for the Japanese currency. There will be the threat of further capital repatriation if tensions within the banking sector continue to increase.

There was no respite from risk aversion in Asia on Wednesday which prevented any fresh dollar support.

Sterling

Sterling recovered some ground in Europe on Tuesday, but there was a sharp retreat in US trading with a slide to 7-week lows around 1.5585 on stop-loss selling following a break of support in the 1.5615 area. The UK currency did recover some ground as the Euro was unable to sustain gains on the crosses.

The latest government borrowing data was slightly better than expected which had some impact in supporting confidence, but markets remained very uneasy over the growth outlook as MPC member Miles stated that the economy was registering close to zero growth.

The Bank of England minutes will be watched closely on Wednesday. There will be a particular focus on whether some members called for additional quantitative easing at the November meeting and whether there were hints of further near-term action. Sterling should have priced-in a broadly dovish set of minutes, but a very downbeat outlook would still have a negative impact on confidence.

Swiss franc

The dollar found support close to 0.91 against the franc on Tuesday and edged higher during the day, although it was difficult to make much headway as the Swiss currency strengthened on the crosses with the Euro retreating to a six-week low to test support below 1.23.

There has been a lack of consistency in franc trading over the past week and over the past 24 hours there has been some evidence of increased defensive demand as risk appetite has deteriorated further. There will still be a high degree of unease surrounding the potential for National Bank intervention which will curb speculative franc buying.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

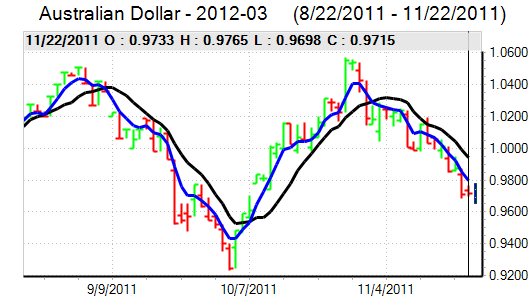

Australian dollar

The Australian dollar was unable to move back above the 0.99 level against the US currency on Tuesday and dipped sharply again from early in the Asian session on Wednesday with lows just above 0.9750. The latest Chinese PMI report was weaker than expected which undermined confidence in the regional economic outlook and also had a further negative impact on Australian dollar confidence, especially with risk appetite already extremely fragile.

The domestic data was stronger than expected with a solid increase in quarterly construction orders, but the impact was limited as global risk considerations dominated.