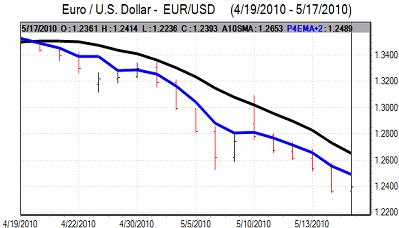

EUR/USD

The Euro was unable to gain any relief in Asian trading on Monday with stop-loss selling following a break of 1.2330 support pushing the currency to four-year lows near 1.2230. There were persistent fears surrounding the Euro-zone economy and the potential for instability which undermined the currency.

There was a generally downbeat assessment of the situation by ECB President Trichet who stated that the economic situation was the worst faced since at least 1945. In this environment, there were continuing fears over an environment of weak growth and potential long-term break-up of the Euro.

Speculative short Euro positions remained at record levels according to the latest data and this may provide some degree of protection from further selling, especially as there will be bouts of short covering.

The US growth-orientated data was mixed as a decline in the New York manufacturing index to 19.1 for May from 31.9 the previous month was offset by a rise in the NAHB housing index to 22 from 20 which was a 30-month high for the construction index.

The latest capital account data recorded strong long-term inflows of US$140.5bn for March from US$47.1bn the previous month which will tend to help underpin medium-term dollar sentiment.

Libor rates continued to edge higher during the day which provided some degree of dollar protection, but the Euro did manage to recover from over-sold conditions and recovered to the 1.2380 region.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk conditions were again important in Asian trading on Monday and there was a sharp deterioration in confidence as equity-market selling intensified.

There was a reduction in carry-trade activity and there were also fears that there would be capital repatriation from Europe given the persistent sovereign debt fears surrounding the Euro-zone.

The domestic data recorded a 5.4% increase in core machinery orders for April which reversed the March decline, but was slightly below market expectations. International trends tended to dominate and the yen strengthened slightly against the dollar while making strong gains on the crosses with the Euro below 113 against the Japanese currency.

The dollar found support below the 92 level during the day and recovered to near 92.50 later in the New York session.

Sterling

Sterling was subjected to heavy selling pressure in Asia on Monday with a 12-month low close to 1.4250 against the dollar. Risk appetite deteriorated sharply and there was also general US strength which undermined the UK currency.

The UK government announced that it would set up an Office of Budget Responsibility to oversee economic forecasts and there will be an emergency budget in the third week of June in which spending will be reduced for the current fiscal year.

There will be relief that the deficit is being tackled, but the positive impact on Sterling is likely to be offset by fears over weak growth and the fact that the underlying deficit is even worse than feared.

The economic data provided some degree of support with the CBI industrial-orders survey registering an improvement to -18 for May from -36 previously. The latest inflation report will be watched closely on Tuesday and a higher than expected reading would maintain some pressure on the Bank of England to tighten policy. Given the prospect for fiscal tightening, the bank is more likely to keep rates on hold in the short term and a higher rate may increase volatility.

Sterling recovered during the day and re-approached the 1.45 later in New York with the Euro holding above the 0.85 level.

Swiss franc

The dollar pushed to a high close to 1.1450 against the franc on Monday, but was unable to hold the gains and weakened back to 1.13 later in the US session. The Euro was able to hold just above the 1.40 level against the Swiss currency during the day.

National Bank President Hildebrand stated that the Swiss currency strength jeopardised the economic recovery and that the bank would react flexibly and decisively. These comments suggest that there will be intervention at times, but that the bank will still be reluctant to defend individual levels for long.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

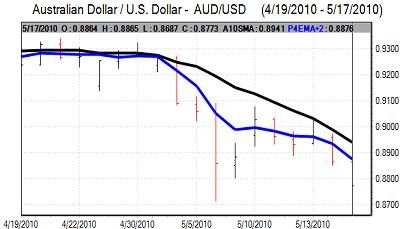

Australian dollar

This pattern continued in local trading on Monday with Asian stock markets falling sharply and there were Australian dollar lows near 0.8725 against the US currency. Confidence is liable to remain more fragile in the short term with unease over the sovereign-debt defaults while commodity prices have also been broadly on the defensive.

Following a brief recovery back to above 0.88 against the US dollar, there was a fresh decline to lows below 0.87 in New York before a recovery to 0.8770 late in New York.