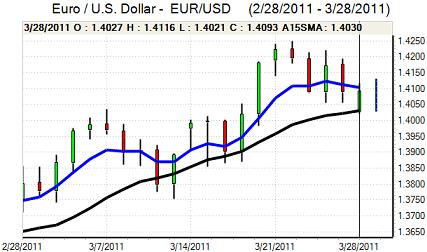

EUR/USD

The Euro retreated to lows around 1.4025 against the dollar during European trading on Monday, but was able to secure a significant recovery later in the day as monetary policy remained extremely important for market sentiment.

Within Europe, ECB president Trichet maintained his hawkish tone with comments that inflation remained durably above target. With the next ECB policy meeting 10 days away, the remarks clearly indicate that the central bank is still planning to raise interest rates despite serious stresses surrounding the sovereign-debt outlook. There were further expectations that Portugal would soon require EU support and continuing fears surrounding the Irish banking sector with expectations that stress-test results would show the need for further capital, but the Euro proved broadly resilient with further reports of sovereign buying at lower levels.

The US economic data did not have a major impact with personal spending slightly higher than expected while pending home sales rose 2.1% for February following a 2.8% decline the previous month.

US monetary policy considerations also remained very important as comments from Fed officials remained under close scrutiny. In contrast to the more hawkish comments seen on Friday, there were more dovish remarks during Monday. Regional Fed President Evans stated that substantial policy accommodation remained appropriate, dampening expectations that there would be a near-term shift in Fed strategy.

Safe-haven considerations will remain potentially important with unease over the situation in Libya and underlying tensions within the Middle East. The Euro recovered to a high above 1.41 before edging lower in Asian trading on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make a serious challenge on the 82.00 area against the yen during Monday and consolidated near the 81.80 area as narrow ranges prevailed in an absence of fresh trading incentives.

There were renewed concerns surrounding the Japanese nuclear situation which dampened risk appetite to some extent and the dollar was also unable to gain fresh support on yield grounds following generally dovish comments.

The Japanese unemployment rate declined to 4.6% from 4.9% previously which was offset by a renewed decline in household spending and the data failed to have a major impact. Underlying confidence in the medium-term economic outlook remains weaker and there were expectations that capital repatriation would fade which would curb yen support.

Sterling

Sterling remained under pressure during Monday and dipped to two-month lows around 1.5935 against the US dollar while the trade-weighted index declined to a 2011 low.

Underlying sentiment remained weaker with further reported declines in business confidence and there were increased fears that the tight government fiscal policy would have a greater than expected impact in weakening the economy. There were also expectations that weak growth would deter the Bank of England from more than a marginal monetary tightening which would leave interest rates highly negative in real terms.

The fourth-quarter GDP revision will be watched closely on Tuesday and any further downward revision would reinforce negative sentiment. The series of PMI releases, starting with the manufacturing data on Friday will also be very important for sentiment as they will set the tone for April’s trading.

Swiss franc

The dollar peaked around 0.9230 against the franc during Monday, but it was unable to sustain the gains and dipped to a low around 0.9150 during the US session as the franc regained some ground on the crosses.

In its latest report, the International Monetary Fund (IMF) stated that the Swiss National Bank should start raising interest rates in order to contain inflationary pressure and market expectations of higher interest rates will provide some degree of support for the franc.

Defensive considerations will remain important, especially with the Swiss currency seen as the last-remaining global safe-haven.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

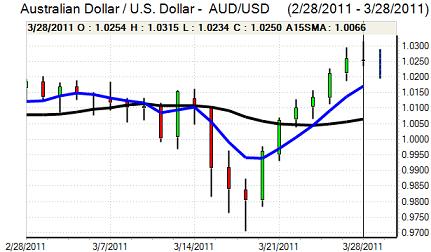

Australian dollar

The Australian dollar was unable to hold above 1.03 against the US currency during Monday and retreated to the 1.0225 area before finding fresh buying support. Underlying sentiment towards the currency remained robust while yield support remained intact and there was further underlying support from the strength of commodity prices.

The currency was hampered by pressure for a corrective retreat following sharp gains over the past 10 days and there were also residual unease surrounding the outlook for Asian monetary policies.