EUR/USD

The Euro remained under pressure during the European session on Tuesday, but found support in the 1.3150 area and was able to recover strongly during the New York session as important technical support held.

There was a continuing lack of confidence in Greece with strong expectations of a medium-term default, especially after any decision on the next loan payment was delayed until November. The Greek government stated that it had enough funding until mid-November, but there were still strong expectations of a much bigger private-sector debt write-down as part of a repackaged rescue programme.

There were further fears surrounding the banking sector with the Belgian authorities announcing a fresh support package and effective nationalisation for Dexia Following the ECOFIN meeting, there was a report that the EU was actively considering a more radical plan to implement bank recapitalisation across Europe and this had an significant positive impact on the Euro.

ECB President Trichet defended the use of non-standard measures in testimony to the French parliament. He was also less dovish than expected on the economy which dampened immediate market speculation over a cut in interest rates at Thursday’s ECB meeting. This shift in expectations will, however, expose the Euro to heavy selling pressure if there is a rate cut.

Fed Chairman Bernanke remained extremely cautious surrounding the economy with comments that it was close to faltering. He also stated that all options would be kept under consideration, although there were no immediate plans for further quantitative easing.

The Euro rallied sharply to a peak around 1.3360 as there was a strong recovery in equity markets before dipping again following an Italian ratings downgrade with consolidation around 1.33.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to the 76.50 area against the yen on Tuesday and rallied back to near the 77 level before stalling again. Movement was still limited by the fact that both currencies tended to move in tandem with risk conditions.

The dollar suffered slightly less from an improvement in risk appetite as there was a flow of funds into US equities.

Bank of Japan Governor Shirakawa described the economic situation as very severe and there will be speculation over additional support measures at this week’s policy meeting scheduled for Friday. A weak tone in Asian equity markets curbed further selling pressure on the yen on Wednesday.

Sterling

Sterling remained under pressure ahead of the US open on Tuesday and tested support below 1.54 against the dollar, close to the lowest level in 14 months. Sterling was also on the defensive against the Euro as exporters took advantage of recent UK currency gains.

Domestically, the construction PMI index fell to 50.1 for September from 52.6 the previous month, maintaining fears over the economic outlook, and confidence will deteriorate further if there is a weak reading for the services sector on Thursday.

There was further speculation over an early expansion of quantitative easing by the Bank of England and there was inevitably tension ahead of Thursday’s MPC decision. There was still evidence of defensive flows into the UK bond market and Sterling was able to hold above the 1.54 area.

Swiss franc

There was high volatility in the Swiss franc on Tuesday as the Euro found support in the 1.2130 area and then rallied strongly to highs above 1.2230 during the US session. There was renewed speculation that the National Bank would target further franc weakness, especially after a run of disappointing economic data. The dollar was blocked in the 0.9250 area and dipped sharply to near 0.9150 during New York trading.

Any credible plan to recapitalise the Euro-zone banking sector would be likely to have a significant impact on the Swiss franc and would generally be negative for the currency with reduced potential for defensive capital inflows.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

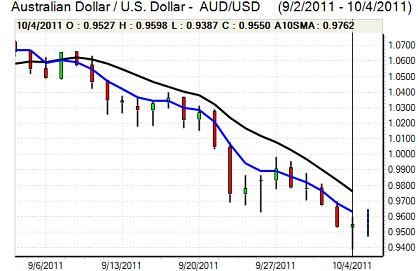

Australian dollar

The Australian dollar continued to decline sharply in Europe on Tuesday and weakened to 16-month lows just below the 0.94 level as commodity prices and equity markets were both subjected to heavy selling pressure,

There was a sharp reversal during the US session as the Australian dollar rallied back above the 0.95 level, in tandem with a recovery in the Euro. There was also a sharp rebound on Wall Street which supported the currency.

Even with a stronger than expected retail sales report, there was still an increase in expectations surrounding an interest rate cut which curbed underlying demand for the currency.