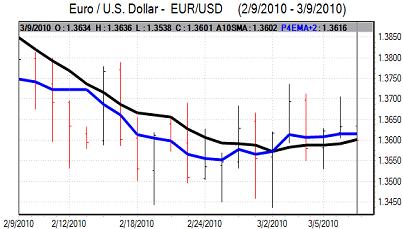

EUR/USD

The Euro was unable to make any headway in early European trading on Tuesday and there was a renewed test of support close to the 1.36 level. The Euro was subjected to further selling pressure during the Europeans session with a low close to 1.3535.

There was a continuing lack of confidence in the Euro-zone economy with fears that tensions surrounding Greece would spread to Portugal and Spain. Ratings agency Fitch was cautious over the medium-term outlook for Greece while there was also evidence of increased tensions within the Greek government which could derail plans for budget cuts. There was also a general mood of risk aversion which curbed demand for the currency.

The latest US IBD consumer confidence index was weaker than expected with a decline to 45.4 in March from 46.8 the previous month, in contrast to expectations for a modest increase. There are no major US economic data releases until Thursday and the dollar has been unable to draw further support on yield grounds which made it more difficult for the US currency to challenge resistance levels. There will still be expectations that the US will out-perform the Euro-zone over the next few months.

There was a modest recovery in risk appetite during New York which helped underpin the Euro and it edged back towards 1.3590, although there were reports of sell orders above 1.36.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen maintained a firmer tone in Asian trading on Tuesday with the US currency dipping to just below 90 against the Japanese currency. There was further speculation over capital repatriation by Japanese corporations ahead of the fiscal year-end and there was also increased exporter selling above the 90 level.

There were also expectations of regional capital inflows which provided some degree of support for the yen. The Euro was unable to sustain the recovery seen during Monday and weakened back towards 122 as underlying confidence remained fragile.

The dollar was able to resist a decline to below 89.50 and it rallied back to near the 90 level as equity markets looked to gain ground which curbed defensive dollar support.

Sterling

The latest RICS house-price index was weaker than expected with 17% of agents reporting higher prices in March from a revised 31% the previous month which continued to fuel doubts over the economy, although the latest BRC retail sales indicator was stronger than expected.

Sterling tested support close below 1.50 against the dollar on Tuesday following the house-price data.

The latest trade account data was significantly worse than expected with the goods deficit widening to GBP8.0bn for January from a revised GBP7.0bn the previous month and this was the widest shortfall since August 2008. The decline in exports was a particularly disappointing feature and will tend to damage underlying Sterling sentiment.

Credit rating agency Fitch also stated on Tuesday that the credit profile has deteriorated which increased speculation that the AAA sovereign credit rating could be lost in the medium term. Fitch stated that there was no immediate threat to the rating, but also sounded an important note of concern over the commercial banks.

Following this series of negative news, Sterling dipped to a low around 1.4935 against the dollar before a rally back to near 1.50 as the dollar was subjected to wider selling.

Swiss franc

The dollar pushed to a high just above the 1.08 level against the franc on Tuesday, but was unable to sustain the advance and retreated back to the 1.0750 region during the US session. The Euro remained locked into very narrow ranges and edged slightly lower to 1.4620.

Swiss consumer prices rose 0.1% in February to give an annual increase of 0.9% which was slightly below expectations. The National Bank will remain wary over any potential deflation threat, but there will still be some speculation that the bank will be more tolerant of franc gains following Thursday’s council meeting and this should help protect the currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

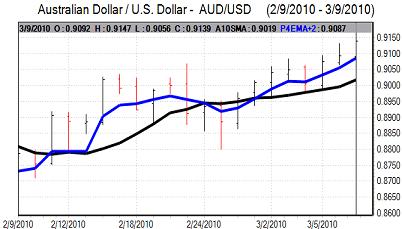

Australian dollar

The Australian dollar continued to find support below 0.91 against the US currency on Tuesday with a robust reading for the job ads survey helping to underpin the currency in local trading.

There was a low near 0.9050 during European trading, but a general recovery in risk appetite pushed the currency back to 0.9130 later in New York as equity markets rallied.