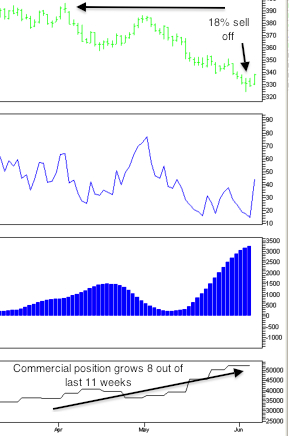

The Copper market has sold off between 18 and 20% since failing to make new highs in early April.

Small Specs and Index funds have hitched their horses to the global deflation bandwagon. This can be seen in their record short position COT Extreme.

Commercial have been steady buyers on dips. The recent pullback has accelerated their purchases. In fact, they’ve increased their net position in 8 out of the last 11 weeks.

The sell off was enough to push the market into oversold territory in spites of strong commercial buying. We expect this market to turn higher and we will place our protective sell stop at the recent low of 323.80.