The answer to the question posed in the article title depends on your honest assessment of these four issues:

- The quality of the trading concept that the system is founded on.

- You ability to properly evaluate the trading system’s back-and forward tested statistics.

- Your ability to fund the system with more than the minimum recommended amount of capital.

- Your willingness to take every trade signal that the system generates, even if it means trading all the way through a sustained period of system draw down. Only if you have 100% confidence in your trading system will you have the psychological fortitude to trade it consistently and profitably.

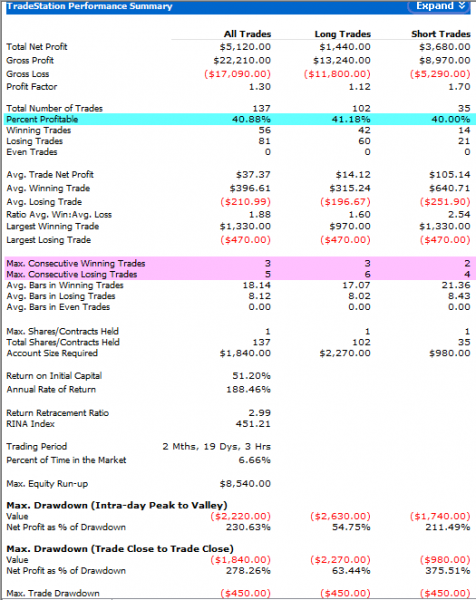

Here’s the out of sample, forward test stats of a system of an intraday futures trading system, called TF Trends. The system trades the emini Russell 2000 futures contract on an intraday basis, going to cash by the end of each daily session. Most traders would be very happy with a system that generated equity growth like this over a 2 ½ month period. However, could you really have handled the low winning percentage rate of 40.88%? Could you have continued to trade the system, even after the five consecutive losing trades that occurred at one point, or would you have taken a break?

If you said ‘no way’ to both questions, then you probably aren’t a good candidate to trade a trend following strategy, no matter if it’s an intraday or daily-based system. But if you are able to get the ‘big picture’ and realize that the profit factor, net profit and maximum peak to valley draw down statistics are the primary statistics for any system, then you already know that the win-loss percentage and maximum consecutive loss figures are of only secondary importance.

So, the big idea here is this – the next time you see an ad touting a 70, 80 or even 90% win rate for a trading system, take some time to dig a little deeper into the raw stats of such systems before you plunk down your hard earned cash for it. Always remember that the profit factor, net profit and maximum peak to valley draw down are the most critical factors to be aware of, no matter what kind of system you finally settle on. Your own personal trading temperament will ultimately determine how successful your trading endeavors will be, assuming that the system you’ve selected resonates well with your emotional ability to keep trading it through whatever the market may throw your way.

Author bio:

Donald has been trading/investing since 1979; since 1999 he has been developing stock, etf and futures trading systems using various system development platforms, including Metastock and TradeStation. He’s also had more than 380 articles published by various trading related magazines, newsletters and websites since 2008.

His website address is www.chartw59.com