Sunday is the big day.

On March 16, the residents of Crimea will vote in a referendum to determine whether the peninsula remains part of Ukraine or whether it secedes and eventually merges with Russia.

While the sovereignty status of Crimea matters very little to the lives of any Western investors, how Russia responds to the results will determine the direction of the market next week.

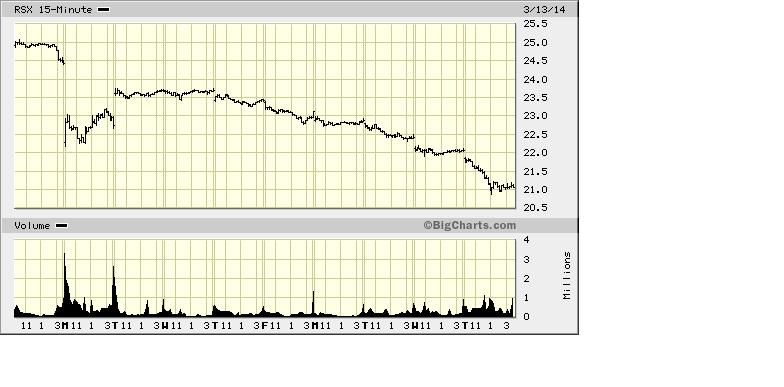

From the looks of things, the market is pricing in the worst. Thursday was one of the worst days in the market since early February, spurred by bad data coming out of China and an escalating war of words between Russia and Western leaders.

The key here is “war of words.” Germany’s Angela Merkel spoke of “catastrophe” for Russia unless Vladimir Putin backed down, and US Secretary of State John Kerry talked sternly about Russia making “bad choices.” But so far, the only consequences of note have been threatened travel bans and asset seizures of prominent Russian political figures. And given European dependence on Russian energy and the need for Russia’s influence in containing Syria and Iran, it’s hard to see sanctions of any real substance being imposed.

Last week, I recommended Russian stocks as a contrarian buy, but recommended an initial stop loss at $22.00, which we penetrated on Thursday. Don’t be in a hurry to jump back into this trade, but if we see more downside on Friday or Monday, I would recommend taking a small position and averaging in as the situation defuses and Russian stocks rally.