The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!

Today’s Golden Sunrise

Tuesday, June 08, 2010

Hours of daily research consolidated for you

Crisis of Confidence?

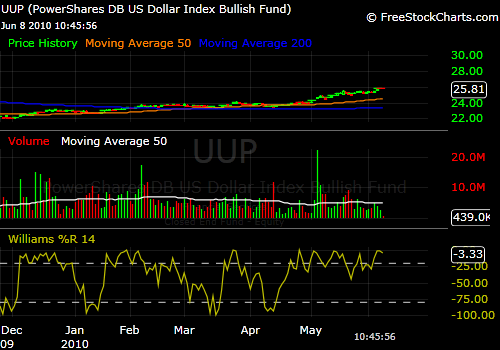

Given the mess in the United States, debts on debts on debts on every level, this rise in dollar is a reflection of weakness everywhere else.

Stronger dollar has meant a weaker US stock market: the S&P ETF

The Euro, which reflects the mess and lack of confidence in the leaders and political will to rectify the situation. Britain has now come under the downgrade spectrum and the United States will follow.

The Eur/USD: Welcome to Ugly World.

Gold expressed the etf GLD: above 50,200 nice slope upward

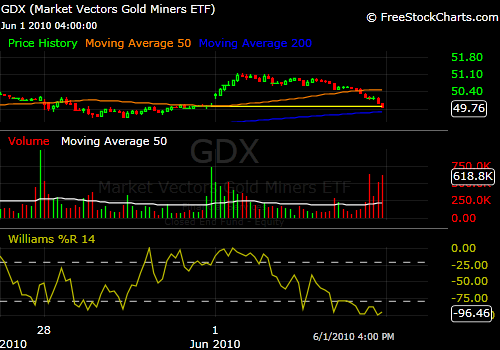

The gold stocks have lagged gold to this point:

The GDX-larger cap miners: haven’t matched gold’s rise

The GDXJ-loaded with quality juniors-explorers, new producers-wealth still in the ground and this will be the shopping mall for gdx producers looking to maintain reserves. Flatter slope..lagging gdx

And lagging most of all and has ration to gold that has now hit 70.

SLV, the silver etf-for centuries the ratio as 15-16 to 1.

The metals have been volatile but they are telling a story about the public’s belief in government officials to successfully manage this crisis using the very same blueprints and tools that created it. And within this asset-class, there appears to be some real opportunities.

JohnR

Goldensurveyor.com