We are in the heat of the summer driving season, and of course consumers are watching the rise in crude oil this year and retail prices at the gas pump. However, as a trader, I think it’s time to look beyond the summer season and start setting up strategies in NYMEX gasoline and crude oil futures now, for a possible shift in trend into fall and winter.

Crude Oil

Given slack demand tied to the global recession, some have questioned whether recent gains in crude oil are indeed justified. I am one of the biggest commodity bulls out there (I had recommended buying oil in January and February), but I do think crude oil is a bit toppy, and the charts are showing a potentially bearish crossover right now that could be indicating a near-term correction.

NYMEX July crude oil futures have been struggling to move above $70 a barrel, and I think a correction could take the market down to $65, the 200-day moving average, or lower, to the 50-day moving average at $61. I see that as a good value area to buy in line with a resumption of another leg up in July and August.

You might want to consider buying a September $65 put, just above that 200-day moving average, then go long the futures at $65. The option acts as a hedge on the downside. You would want to exit the trade around the in the middle of July, where I think crude oil prices could peak.

You could consider scaling in; you might buy August futures contract at $64, $62, and $60.

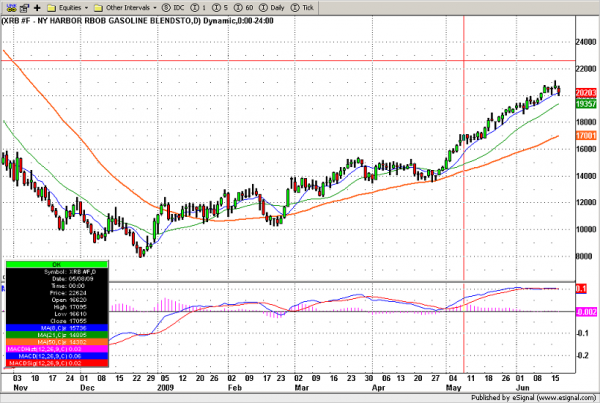

Gasoline

Like crude oil, RBOB gasoline tends to peak in the summer, and should pull back once we get through driving season and hurricane season. Assuming some of the Middle-East political unrest we are experiencing now abates, we should prices pull back heading into 2010, in line with traditional supply and demand fundamentals. Of course past tendencies can’t be relied upon when you trade, but typically, gasoline demand drops and prices tend to bottom in January and February. I recommend buying puts now, then look to get long again early next year once we see signs the market is starting to bottom out and inflation becomes a bigger concern as our economy improves.

For now, it seems like we have plenty of inventory, but the market hasn’t really reacting to what should be bearish news. According to the latest inventory report by the Energy Information Administration (EIA), gasoline inventories climbed 3.39 million barrels to 205 million in the latest weekly reporting period. The rise was more than six times the size forecast by analysts surveyed by Bloomberg News.

I recommend buying gasoline puts, but go out to February 2010 and consider the 1.20 puts, which cost about $600 not including your commission charges. Gasoline is experiencing what’s called backwardation right now—the farther-dated contracts are trading lower than the front-month contract. July gasoline futures are currently trading at just above $2.03 a gallon, while the October 2009 contract is trading at $1.8726 and the February 2010 contract is at $1.9074.

Please feel free to contact me for more information on these or other strategies to suit your particular situation. Ask about our half-off offer for new clients.

Richard Ilczyszyn is a Senior Market Strategist with Lind Plus, the broker-assisted division of Lind-Waldock. He can be reached at 800-605-0095 or by email at rilczyszyn@lind-waldock.com. He also presents a monthly webinar entitled, rilczyszyn@lind-waldock.com. He also presents a monthly webinar entitled, The Business of Day Trading. You can register for his next webinar here.

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

Futures trading involves substantial risk of loss and may not be suitable for all investors. 2009 MF Global Ltd. All Rights Reserved. Futures Brokers, Commodity Brokers and Online Futures Trading. 141 West Jackson Boulevard, Suite 1400-A, Chicago, IL 60604.