By FXEmpire.com

Crude Oil Fundamental Analysis April 12, 2012, Forecast

Analysis and Recommendations:

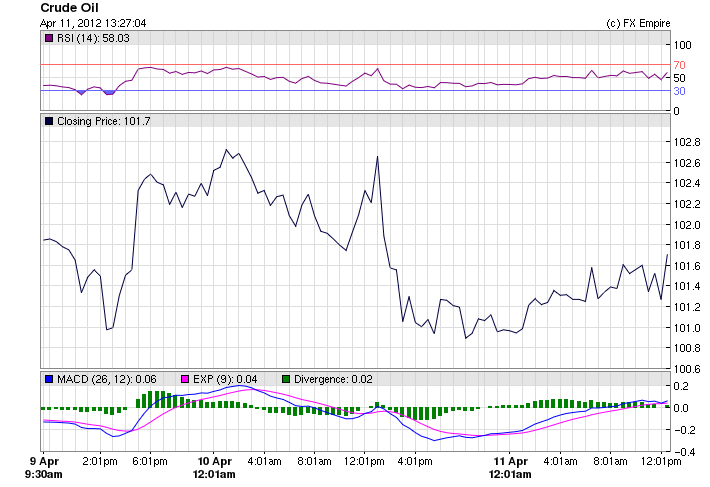

Crude Oil climbed to 102.22 up 1.20 in today’s session. Crude just bounced a bit today to offset the continuous fall since last week.

The Energy Information Administration said crude supplies rose 2.8 million barrels on the week ended April 6. That compares to expectations of a rise of 1.8 million barrels in the week, and comes after two weeks of huge increases. The EIA also reported gasoline supplies declined 4.3 million barrels, and inventories of distillates were down 4 million barrels. The analysts surveyed by Platts had expected gasoline supplies to drop 1.25 million barrels, and distillates supplies to increase 200,000 barrels.

Markets are waiting for the U.S. Federal Reserve Beige Book, the Fed’s official assessment on economic conditions in the 12 Federal Reserve districts due later today. The report is released exactly two weeks before the Fed’s next monetary policy meeting on April 24-25, the Beige Book report should confirm the signs of consistent improvement in the U.S. economy, lessening the likelihood of more quantitative easing by the U.S. central bank. As long as QE3 odds remain low, the USD should benefit.

Commodities could move either direction after this report.

Economic Reports April 11, 2012 actual v. forecast

|

Apr. 11 |

AUD |

Westpac Consumer Sentiment |

-1.60% |

-5.00% |

|

AUD |

Home Loans (MoM) |

-2.5% |

-3.5% |

-1.1% |

|

JPY |

BoJ Monthly Report |

|||

|

HUF |

Hungarian CPI (YoY) |

5.5% |

5.7% |

5.9% |

|

EUR |

German 10-Year Bund Auction |

1.770% |

1.830% |

|

|

Housing Starts |

216K |

200K |

205K |

|

|

USD |

Import Price Index (MoM) |

1.3% |

0.8% |

-0.1% |

Economic Events that affect Crude Oil for April 12, 2012

13:30 CAD Trade Balance 2.0B 2.1B

The Trade Balance measures the difference in value between imported and exported goods and services over the reported period. A positive number indicates that more goods and services were exported than imported.

13:30 USD Core PPI (MoM) 0.2% 0.2%

13:30 USD PPI (MoM) 0.3% 0.4%

The Core Producer Price Index (PPI) measures the change in the selling price of goods and services sold by producers, excluding food and energy. The PPI measures price change from the perspective of the seller. When producers pay more for goods and services, they are more likely to pass the higher costs to the consumer, so PPI is thought to be a leading indicator of consumer inflation. The Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers. It is a leading indicator of consumer price inflation, which accounts for the majority of overall inflation.

13:30 USD Trade Balance -52.0B -52.6B

The Trade Balance measures the difference in value between imported and exported goods and services over the reported period. A positive number indicates that more goods and services were exported than imported.

13:30 USD Initial Jobless Claims 355K 357K

13:30 USD Continuing Jobless Claims 3335K 3338K

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance.

WEEKLY

-

This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) -

Gasoline and Diesel Fuel Update

Release Schedule: Monday between 4:00 and 5:00 p.m. EST (schedule) -

Weekly Petroleum Status Report

Release Schedule: The wpsrsummary.pdf, overview.pdf, and Tables 1-14 in CSV and XLS formats, are released to the Web site after 10:30 a.m. (Eastern Time) on Wednesday. All other PDF and HTML files are released to the Web site after 1:00 p.m. (Eastern Time) on Wednesday. Appendix D is produced during the winter heating season, which extends from October through March of each year. For some weeks which include holidays, releases are delayed by one day. (schedule)

Originally posted here